There’s something timeless about that first spark of wanting a place to call your own.

Maybe it started with Sunday drives past picket fences, or stories your parents told about the day they got their keys. Maybe it’s the American flag swaying on the front porch, or the idea of building something—a life, a future, a legacy—on your terms.

Owning a home has always been more than just a transaction. It’s a stake in your community, a piece of the American dream, and a promise to yourself and your family. This first-time homebuyer guide is here to walk with you from the moment you decide you’re ready to the day you turn the key—with clarity, confidence, and no regrets.

Help for New Homeowners

Grab the free AHA New Homeowner Resource Kit — packed with checklists, planners,

and tips to help you stay organized, avoid costly mistakes, and start your

homeownership journey with confidence.

Are You Ready to Buy a Home?

Before diving into listings, start with some honest reflection. Is homeownership the right move for your lifestyle right now? Consider your job stability, long-term plans, and whether you’re ready for the responsibility of upkeep and repairs.

Financially, can you manage more than just a down payment? Owning a home comes with closing costs, property taxes, homeowner’s insurance, moving expenses, and ongoing maintenance. If you’re not prepared for those, now might not be the right time—and that’s okay.

Understand What You Can Afford

A good rule of thumb is to spend no more than 28% of your gross monthly income on housing. But affordability goes beyond your mortgage—you’ll also need to budget for taxes, insurance, utilities, and maintenance.

For a deep dive on how to set your homebuying budget—including debt-to-income ratios, how lenders evaluate your finances, and tips to avoid hidden costs—check out our in-depth article: “How Much House Can I Afford?“

Use AHA’s interactive home purchase budgeting tool

Find the Right Real Estate Agent

A good real estate agent can make your entire homebuying experience smoother—and less stressful. They’ll help you find listings that match your needs, negotiate your offer, interpret inspection and appraisal results, and guide you through the paperwork all the way to closing.

So how do you find the right one?

- Ask for referrals from friends, family, or coworkers who’ve recently bought a home.

- Interview at least two or three agents before committing—ask how they work with first-time buyers.

- Use AHA’s Real Estate Agent Interview Guide

- Look for someone local who knows the neighborhoods you’re considering.

- Make sure they’re responsive and communicate clearly.

Remember: The listing agent works for the seller. You want someone in your corner who understands your goals, your budget, and your comfort level.

Get Pre-Approved for a Mortgage

Once you decide to get serious about homebuying, getting pre-approved for a mortgage is one of the smartest first steps you can take. It gives you a realistic price range to work within, shows sellers you’re a serious buyer, and allows you to act quickly when you find the right home.

A lender will review your financial background—including your income, credit, and debt—to determine how much they’re willing to lend. This isn’t just a pre-qualification—you’ll need to provide financial documents like pay stubs, tax returns, and bank statements., and it shows sellers you’re serious.

Shop around—different lenders offer different rates, and even a small rate difference can save you thousands.

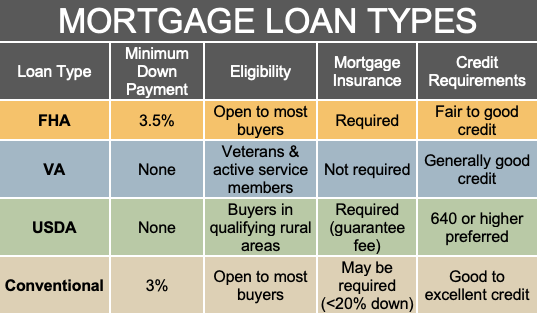

Not sure which loan type is right for you? Here’s a quick guide:

- FHA loans are great for buyers with lower credit scores and smaller down payments (as low as 3.5%).

- VA loans are available to veterans and active-duty service members, often with no down payment and no private mortgage insurance.

- USDA loans help buyers in qualifying rural areas, usually with zero down.

- Conventional loans typically require higher credit scores and larger down payments but may have fewer long-term costs.

Shop Smart: Choosing the Right Home

It’s easy to fall in love with a house’s look. But you need to consider:

- Commute times

- School districts

- Local property taxes

- Age and condition of the roof, HVAC, windows, and plumbing

- Resale value and neighborhood trends

Visit at different times of day and week to spot noise, parking, or traffic issues. Traffic flow can vary significantly depending on the time of year—school-year drop-offs and pickups may dramatically affect how busy the streets are compared to quieter summer months.

Never Skip the Home Inspection

A home inspection helps uncover hidden issues that could become expensive problems. Attend the inspection if you can, and ask questions. You’ll get a detailed report, which you can use to renegotiate or even walk away if the problems are too big.

Use AHA’s DIY Home Inspection Checklist to spot red flags on your own walk-throughs.

Making an Offer and Understanding the Appraisal

When you’re ready to make an offer, lean on your agent for help comparing recent sales of similar homes in the area. A strong offer is backed by data—and often includes smart contingencies for financing, inspections, or appraisal gaps.

Once your offer is accepted, your lender will schedule a home appraisal—this is not something you arrange yourself. The appraiser is a neutral third party who determines the market value of the home to ensure the loan amount aligns with the home’s worth. Your real estate agent will help you understand the appraisal results and what they mean for your purchase. If the home appraises for less than your offer, you may need to renegotiate with the seller or cover the difference out of pocket. If it comes in at or above the offer price, you’re one step closer to closing.

Know the Real Costs of Closing

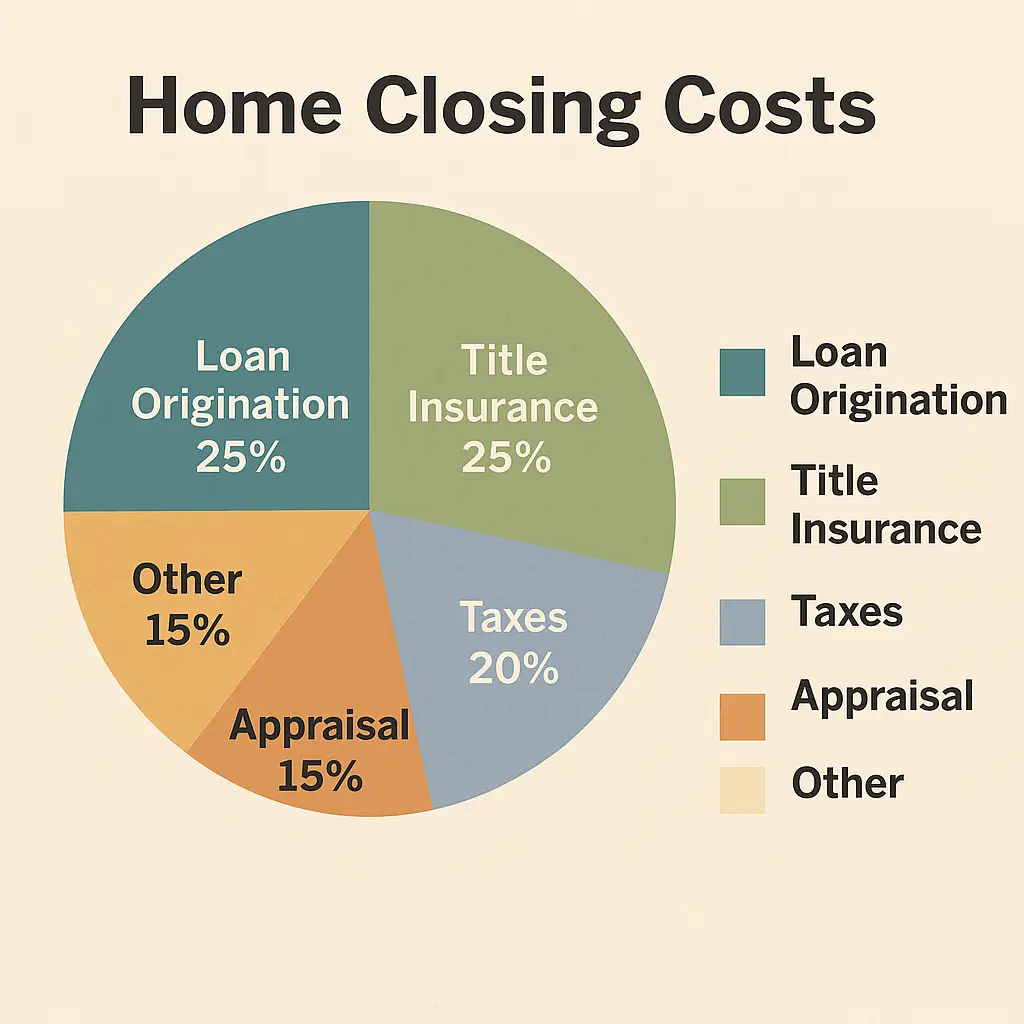

Closing costs usually run 2% to 5% of the home’s purchase price. These include loan origination fees, title insurance, taxes, and more. Your lender should provide a Loan Estimate early on, and a Closing Disclosure three days before closing.

Also budget for:

- Moving costs

- Initial setup of utilities and services

- First year of homeowners insurance

- New locks and basic safety upgrades

AHA’s New Homeowner Resource Kit, which includes checklists, contact organizers, and home setup tips, can help you keep it all organized.

After You Move In: What Comes Next?

Owning a home is just the beginning. Here’s what to do in your first month:

- Change your locks

- Set up your utility accounts

- Introduce yourself to the neighbors

- Review your insurance coverage and emergency fund

- Start a seasonal maintenance checklist

AHA’s Home Maintenance Calendar can help keep you on track.

Conclusion

Buying your first home can feel overwhelming, but with the right guidance and tools, it’s completely doable. Ask questions, stick to your plan, and take it one step at a time.