You finally get the keys. You’re standing in your own kitchen, grinning like crazy. No more rent checks. No more landlords. But a few months in, the bills start piling up—and they’re not what you expected. Property taxes jump. Your water heater dies. The AC needs servicing. Suddenly, owning a home doesn’t feel quite as predictable as the mortgage calculator promised.

If you’re buying (or just bought) a home, it’s crucial to understand what your monthly payment doesn’t cover. Here’s what to expect—and how to stay financially ready.

What Are the Hidden Costs of Homeownership?

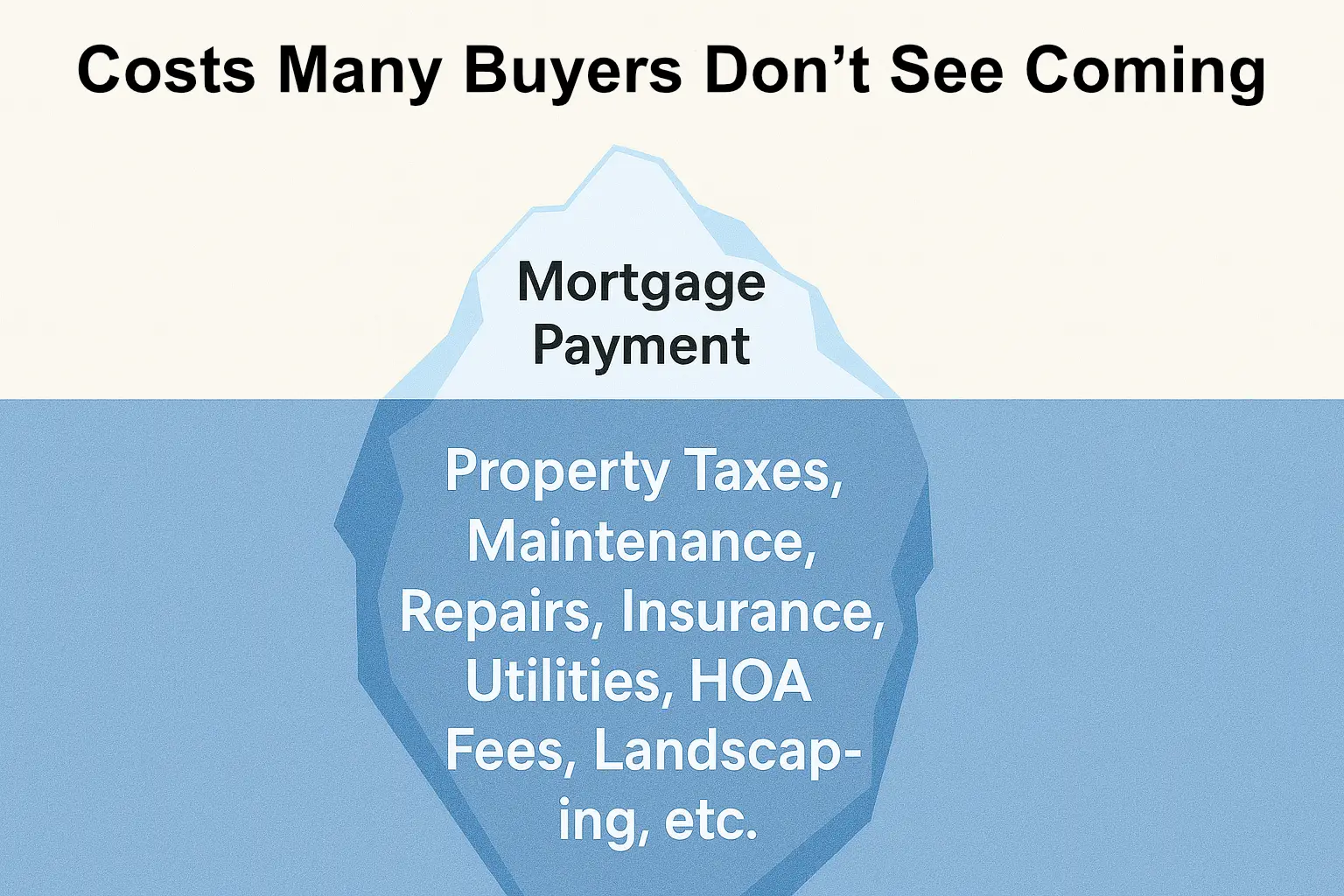

Think of your mortgage as the tip of the iceberg. Beneath the surface are dozens of ongoing costs that many first-time buyers underestimate or overlook altogether.

For example, a recent AHA study of hundreds of real homeowner experiences revealed just how costly surprise repairs can be. From $16,000 roofs to $40,000 sewer line collapses, the numbers go well beyond what most new buyers expect. HVAC failures, foundation issues, and mold damage are among the most common financial shocks—often hitting in the first year of ownership.

These costs aren’t necessarily “hidden” on purpose—but they often show up after the purchase, when you’re already financially stretched.

And the impact is real: Nearly half of homeowners report at least one regret about buying their current home. Of those, 42% say unexpected maintenance and other costs are the biggest reason why. For first-time buyers, it’s even tougher—66% faced surprise issues averaging over $5,300 in unplanned costs their first year.

7 Common Homeownership Costs That Surprise Buyers

- Property Taxes

- Property taxes can go up based on reassessed home value, local levies, or changes in school budgets. Some states see annual increases of 3% or more.

- Watch Out: In hot housing markets, a reassessment after purchase can jack up your tax bill fast.

- Homeowners Insurance

- Premiums have skyrocketed in areas with wildfire, flood, or storm risk. Even if you’re not in a hazard zone, rates are rising nationally.

- Maintenance and Repairs

- Experts suggest budgeting 1% to 3% of your home’s value annually for maintenance. For a $350,000 home, that’s $3,500 to $10,500 per year.

- Pro Tip: Use AHA’s SmartSaver (Coming Soon) to find rebates or discounts on repairs and energy-efficient upgrades.

- HOA Fees and Special Assessments

- If your neighborhood has a homeowners association, those monthly dues can be steep. And if the community needs a new roof or major upgrade? That’s a special assessment—and it’s coming out of your pocket.

- Utilities and Seasonal Bills

- Heating and cooling are major costs. Expect spikes in summer and winter. Also factor in water, trash, and sewer fees that may have been included in rent.

- Landscaping and Exterior Care

- Yard care tools, tree trimming, fencing, pest control—none of it is free, and much of it is essential for curb appeal and safety.

- Appliance Replacements

- Fridge, washer, dryer, water heater… They all have shelf lives. A broken fridge can mean a $2,000 surprise. And guess what? You’re the landlord now.

State-by-State Differences to Watch

Where you live has a huge impact on how much these hidden costs will add up.

- In Hawaii, the average hidden cost of homeownership is over $34,500 per year, including more than $19,000 in maintenance alone.

- California and New Jersey also top the charts, with annual hidden costs over $30,000.

- In contrast, states like West Virginia or Mississippi see averages closer to $12,500/year.

- Some metro areas like Detroit, Cleveland, and Dayton have lower home prices—but still surprise buyers with aging infrastructure and high maintenance needs.

AHA Insight: Homeowners in high-cost states should budget much more aggressively for taxes, insurance, and repairs. Even in more affordable areas, unexpected costs can stretch thin budgets fast.

The “Time Tax” of Ownership

Homeownership doesn’t just cost money—it costs time.

The average homeowner spends 8–12 hours per month on routine tasks like lawn care, seasonal prep, DIY fixes, and appointment coordination with contractors. That might sound manageable… until life gets busy.

If you’re used to calling a landlord when something breaks, this shift can be overwhelming.

How to Plan for These Costs—Without Panic

- Create a dedicated home fund: Start with $2,000-$5,000 minimum for unexpected repairs. Replenish as needed.

- Use AHA tools: SmartSaver (Coming Soon) helps you plan purchases and find rebates. The AHA Insurance Advisor (Coming Soon) can help you review your policy and compare rates.

- Build costs into your monthly budget: Don’t just plan for PITI (principal, interest, taxes, insurance). Add a “home upkeep” line too.

- Review taxes and insurance annually: Look for increases, and explore exemptions or bundling opportunities.

Watch Out: Avoid draining your emergency fund. Keep home-related reserves separate so you’re not caught off guard by a double whammy.

Real Ownership Means Real Awareness

Owning a home is an incredible milestone. But it comes with layers most buyers don’t see until they’re deep into their first year. Understanding the full scope of costs—and planning for them—makes you a smarter, more confident homeowner.

Explore more with the AHA SmartSaver (Coming Soon) and Insurance Advisor (Coming Soon) to take control of your home costs before they control you.