What to Expect & How to Thrive

The moment those house keys hit your palm, everything changes. You’re no longer just a resident—you’re the owner. It’s exciting, empowering, and yes, a little overwhelming. You could use a homeowner first year guide to help navigate the next 12 months. Well, you’re in the right place—read on.

Picture this: It’s your third night in your first new home and the furnace won’t kick on. You’re bundled in coats, Googling the difference between a pilot light and a gas valve. Welcome to homeownership.

Owning a home comes with more than a mortgage. There’s a mental shift, too. You may feel a strong sense of pride, but also the pressure to get everything right. Financially, you’ll face new costs like insurance premiums, utility bills, and surprise repairs. And practically speaking, every creak in the floor or drip from the ceiling now falls under your watch. Welcome to the DIY mindset.

This homeowner first year guide will walk you through the real-world surprises, essential first-year tasks, and expert strategies to not just survive—but thrive—as a new homeowner.

New to Homeownership?

Grab the free AHA New Homeowner Resource Kit — packed with checklists, planners,

and tips to help you stay organized, avoid costly mistakes, and start your

homeownership journey with confidence.

Common Surprises New Homeowners Face

Even with a home inspection, surprises will happen. Here are the top ones:

- Hidden system issues: Water heaters on the verge of failure or aging HVAC systems often reveal their issues months in.

- Seasonal cost shifts: Utility bills can spike in winter or summer, especially if your home isn’t yet energy-efficient.

- Escrow adjustments: Property taxes or insurance premiums may be reassessed, leading to higher monthly payments.

- DIY misfires: Many new homeowners take on ambitious projects without the right tools or know-how.

- Moisture and pest problems: Basement leaks, mold, ants, or mice are more common than most anticipate, especially after moving in.

To help anticipate and avoid these issues, the AHA New Homeowners Resource Kit includes a first-year checklist, home system labeling guide, and seasonal maintenance planner designed to guide you through your home’s quirks, seasons, and systems. The AHA Home Repair Reserve Calculator will help you estimate the amount you should budget.

What Should You Prioritize

There’s a lot you could do, but here’s what you should focus on early—and why it matters:

- Seasonal Maintenance: Following a seasonal rhythm prevents costly disasters and keeps your systems efficient. Cleaning gutters, inspecting your roof, sealing cracks—these add up to long-term savings. Use the Resource Kit’s Seasonal Maintenance Planner to set calendar reminders.

- Emergency Fund Building: Many first-year problems cost $300–$1,500 to fix, with larger repairs like HVAC or sewer issues hitting $5,000–$12,000. A small emergency fund can turn a budget buster into a manageable inconvenience.

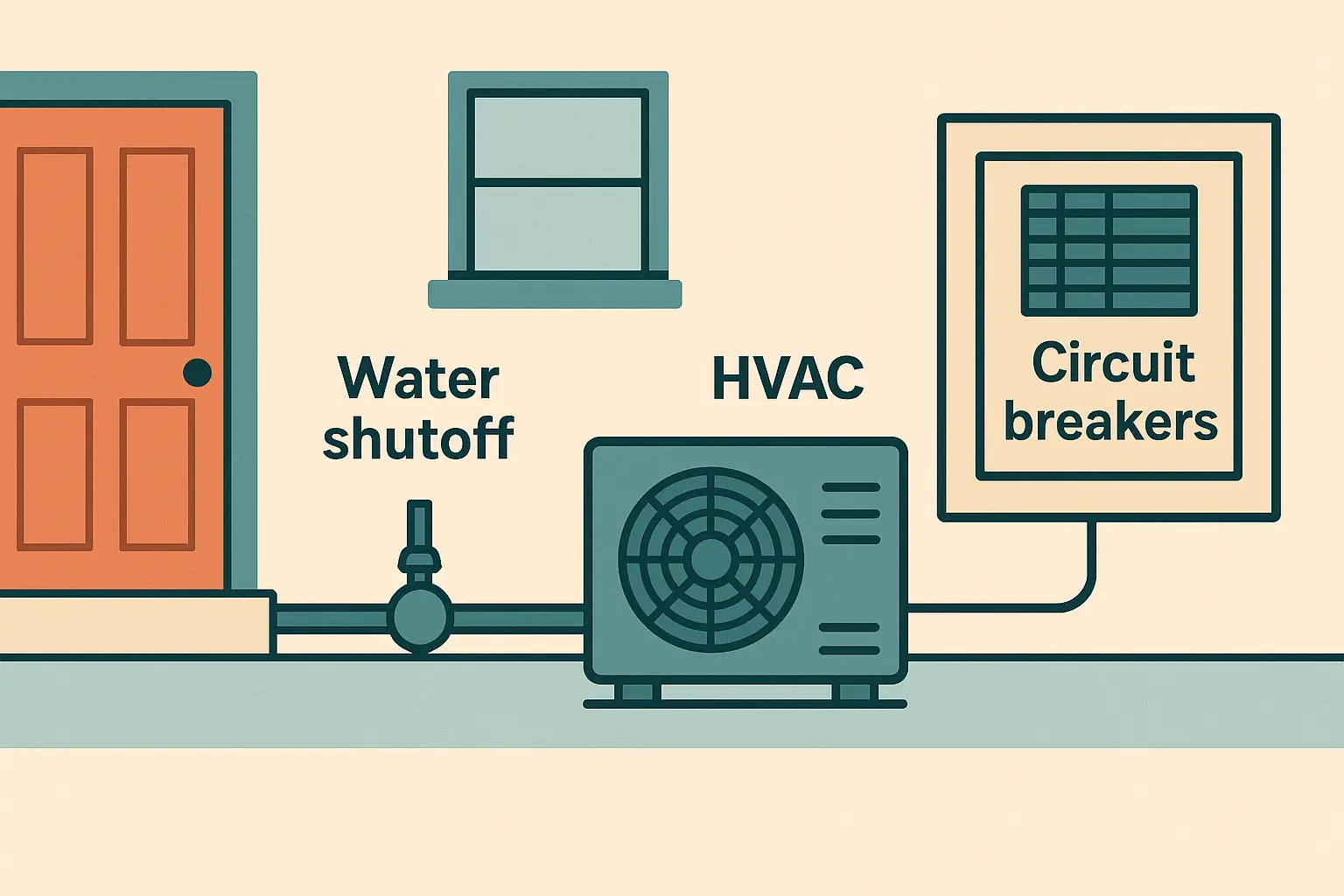

- Know Your Systems: From shutting off water quickly during a leak to resetting your breaker after a power trip, knowing where things are and how they work is critical. Learn how to test GFCI outlets, locate your sump pump, identify gas shutoff valves, and label each circuit in your electrical panel. Use the kit’s guide to walk through each key area.

- Digitize and Organize: Keep warranties, receipts, and manuals in a dedicated folder—digital or physical. When you need to claim a warranty or explain a past repair, you’ll be ready. Start with our included Homeowner Binder Template.

- Watch for Moisture and Pests: These are two of the most common hidden issues in year one. Install simple leak sensors near water heaters or under sinks, and inspect the perimeter for entry points. The Resource Kit outlines what to look for and how to respond.

- Know Your Limits: DIY is empowering, but some jobs (electrical, roof work, structural repairs) should go to a pro.

Your Financial Survival Strategy

A few smart moves can keep your budget balanced:

- Create a first-year home budget, including utilities, upkeep, and insurance.

- Use AHA’s SmartSaver tool to find energy rebates and cost-cutting upgrades.

- Review your insurance policy for gaps or unnecessary coverage.

Set Yourself Up for the Long Game

Start a home logbook to track repairs, paint colors, appliance warranties, and more. Think of it as your home’s medical record. This will pay off later, especially during resale or major projects.

When to Ask for Help

DIY is great—until it isn’t. Know when to bring in a pro. If a repair involves your roof, wiring, or plumbing behind the walls, it’s worth calling someone vetted. AHA’s HomeAssist Hotline can help you locate trusted experts in your area.

Conclusion: Your First Year is Just the Start

That first year may feel like a wild ride—but it’s also one of the most rewarding. Every small repair you learn to handle, every monthly budget you stick to, and every system you take the time to understand is a step toward long-term confidence and comfort in your home.

Homeownership isn’t about perfection—it’s about progress. With the right mindset, smart habits, and tools from AHA at your side, you’ll build a solid foundation not just for your house, but for your future.

Want a deeper dive? Explore the full AHA New Homeowner Resource Kit — with checklists, planners, home system guides, and expert tips to guide you through each season.

You’ve got this. Let’s make year one — an amazing one to remember!