They say the only certainties in life are death and taxes—and if you own a home, property taxes are one of them. But the real shocker? You could be paying more than you owe—and there’s a way to fix it.

Take a typical homeowner who notices their property assessment seems inflated—and takes action. In fact, a recent Realtor.com analysis found that four in ten homes nationwide are over-assessed, and appealing that assessment could reduce your tax bill by a median $539 just by matching your property’s value to local sales.

That’s not money that vanishes into thin air—it’s yours. Imagine having an extra $500, $800, or even more each year—money that could help you pay down your mortgage, fund spring break, or build your emergency savings. Understanding how property assessments work—and how to challenge them—isn’t just smart. It’s financially empowering.

What Is a Property Tax Assessment?

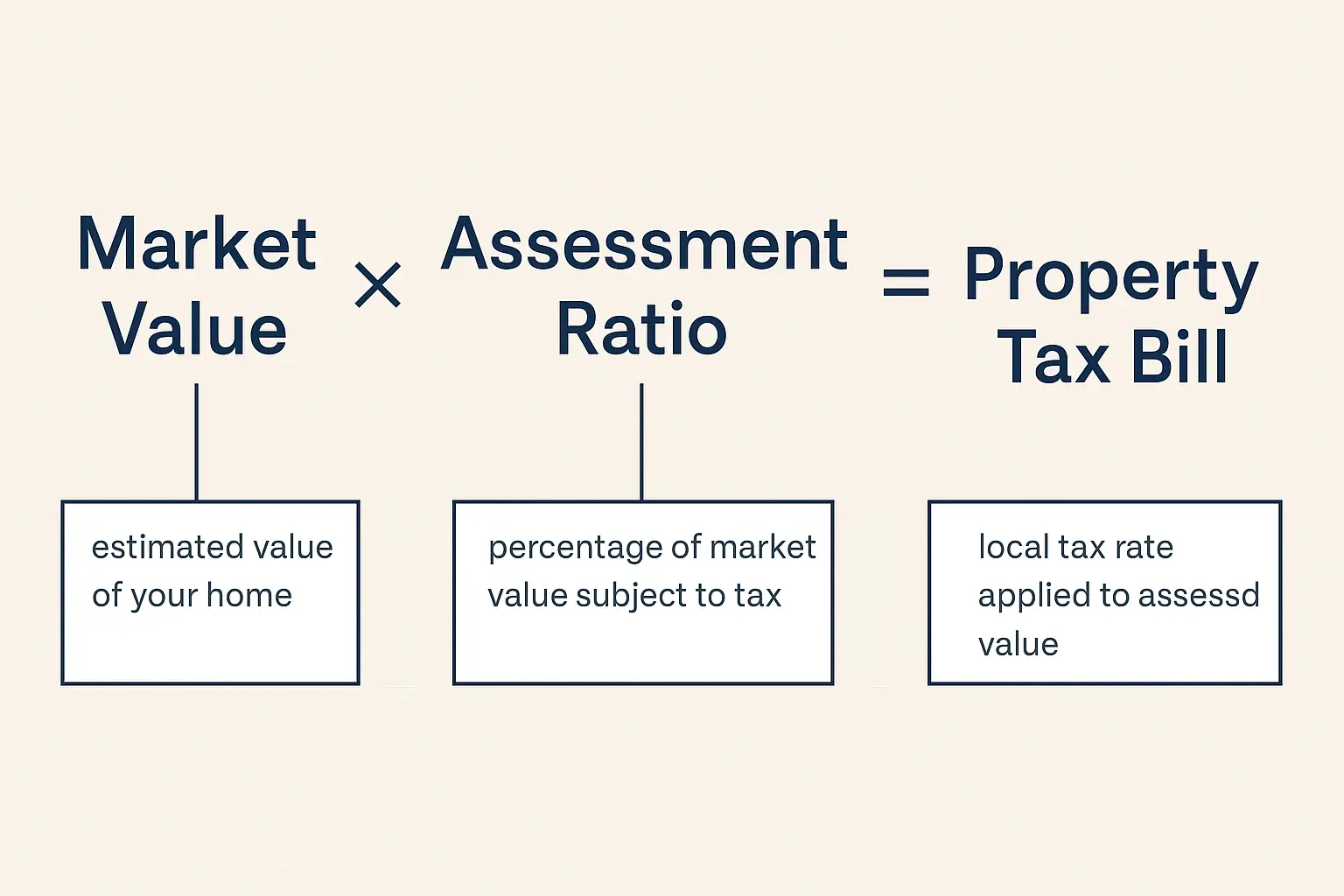

A property tax assessment is the local government’s way of estimating how much your home is worth so they can figure out how much tax you should pay. Typically, this is done by a city or county assessor who assigns a market value to your property. That value is then multiplied by a local tax rate (called a mill rate or levy) to calculate your tax bill.

What is a property tax assessment?

A property tax assessment is a local government’s estimate of your home’s value, used to determine how much property tax you owe.

Once you know what an assessment is, the next big question is how often it happens — and why that matters.

Think Your Property Taxes Are Too High?

Grab the free AHA Property Tax Appeal Toolkit — packed with worksheets, templates, and tips to help you challenge your assessment, cut your tax bill, and keep more money in your pocket.

How Often Are Homes Assessed?

It varies widely. Some areas reassess every year. Others do it every few years or only when a home is sold. If your property hasn’t been reassessed in a while, your tax bill may not reflect your home’s current market value — for better or worse.

Pro Tip: If your home’s value has dropped due to storm damage, local market shifts, or even nearby construction, you may be overpaying in taxes. Check if you can request a reassessment.

What Factors Influence Your Property’s Value?

Assessors look at a mix of data, including:

- Recent sales of similar homes in your area

- Size, layout, and condition of your home

- Land value and neighborhood characteristics

- Improvements like finished basements or new roofs

Importantly, they don’t consider your mortgage, household income, or how long you’ve owned the home. It’s all about the property itself.

So what happens if you think the assessor got it wrong?

How to Review and Appeal Your Assessment

You have the right to review your property’s assessed value — and challenge it if you think it’s too high. Here’s how to get started:

- Watch your mailbox: Your assessment notice typically arrives by mail and lists your home’s estimated value and the tax amount due.

- Do your homework: Look up recent sales of similar homes in your neighborhood. If your home’s value seems inflated, you might have a case.

- File your appeal: Deadlines are usually tight (sometimes just 30 days!). Check your county assessor’s website for forms and instructions.

- Back it up: Photos, contractor quotes, and examples of lower-priced comparable sales can strengthen your case.

AHA Expert Tip: You don’t need a lawyer to file a successful appeal—but you do need to be organized. Use AHA’s DIY Toolkit or Property Tax Appeal Assistant to prepare your case thoroughly. A simple clerical error—like the wrong number of bathrooms—can sometimes lead to a big win.

Common Mistakes That Lead to Higher Taxes

- Unpermitted renovations reported to the city

- Incorrect square footage or building features

- Outdated neighborhood comps still used in calculations

Watch Out: Some jurisdictions automatically increase assessed values annually, even if the market hasn’t moved much. Don’t assume your assessment is fair just because it looks “normal.”

Appeals aren’t the only way to cut your tax bill. Here are other strategies homeowners often overlook:

Other Ways to Reduce Your Tax Burden

- Apply for exemptions: Many states offer homestead exemptions, senior discounts, or relief for veterans or disabled homeowners. Check your local assessor’s site to see what’s available.

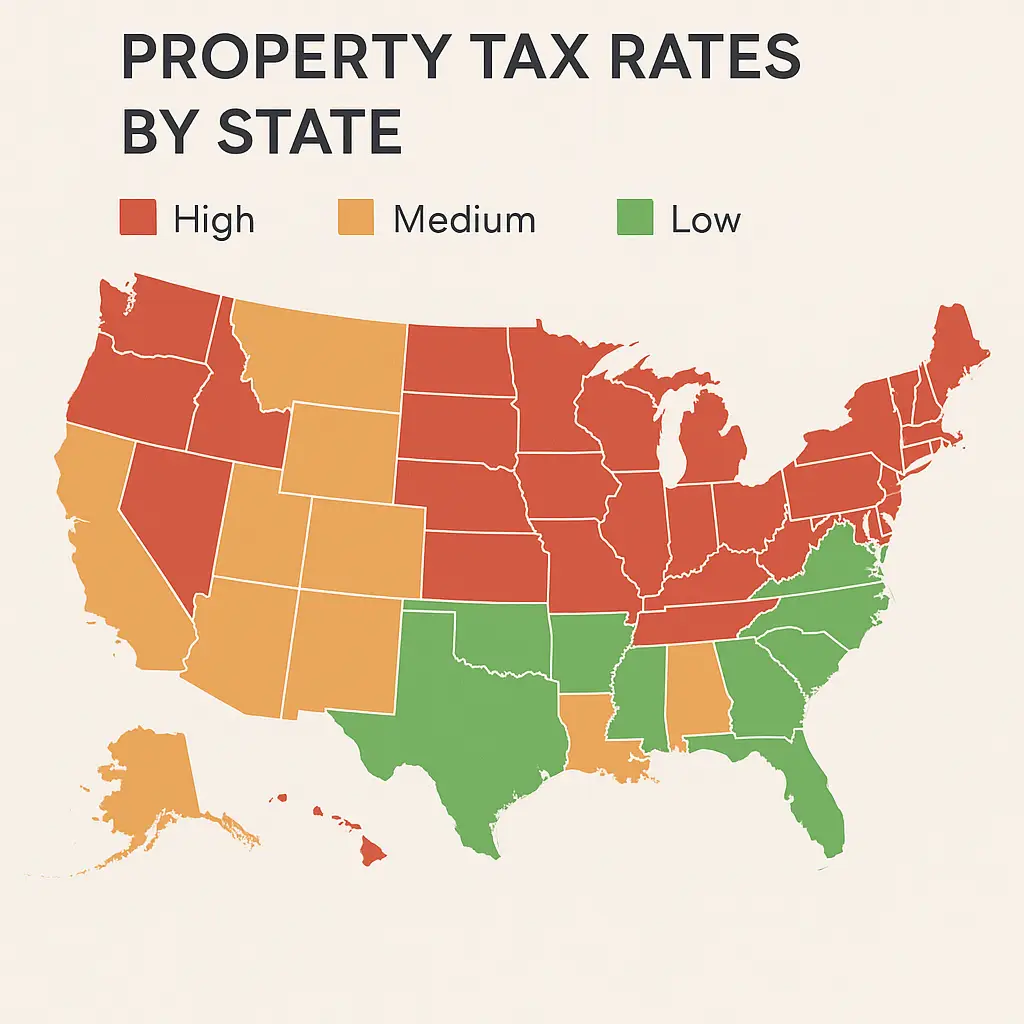

- Check your assessment cap laws: Some states limit how much your assessed value can increase each year, even if your market value jumps.

- Understand federal deductions: If you itemize deductions, you may be able to deduct state and local property taxes up to $10,000 under the current SALT cap.

Your Assessment Isn’t Set in Stone

The assessment process can feel opaque, but it’s not beyond your control. Staying informed, reviewing your records, and speaking up when something seems off can lead to real savings.

Download our free DIY Property Tax Appeal Toolkit to get started with your appeal.

Remember: You can’t escape property taxes — but you can take control of them. And that’s what smart homeowners do.