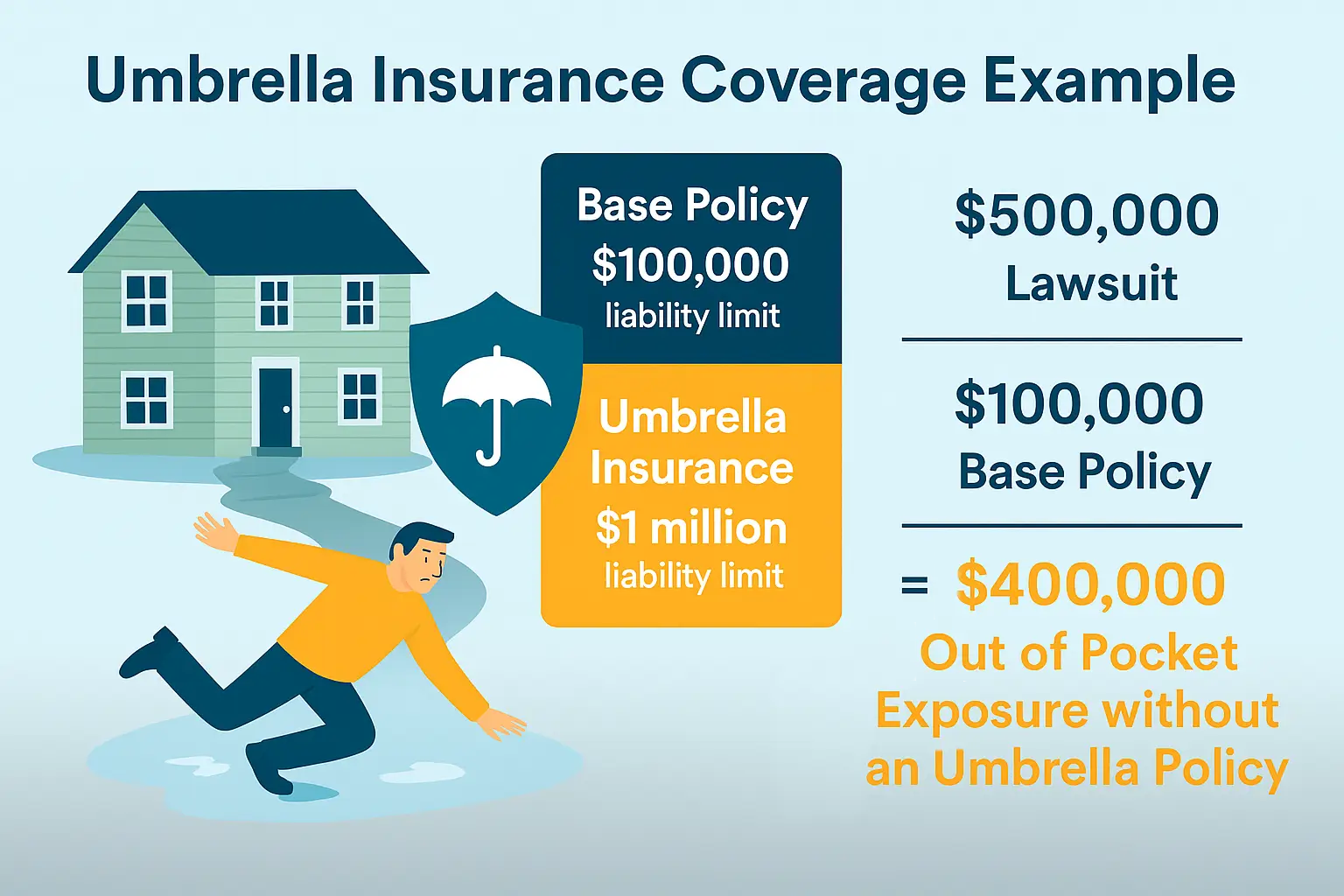

Most homeowners assume their standard policy has them covered for anything life throws their way. But what if someone slips on your icy sidewalk and sues for half a million dollars? Or your teen causes a major car accident and the damages exceed your auto liability limits? A recent survey by the Insurance Information Institute found that many people underestimate how easily a lawsuit could exceed their policy limits.

That’s where umbrella insurance steps in. It’s an extra layer of liability protection — not just for big houses or fancy cars, but for everyday families trying to protect what they’ve worked hard for.

In this guide, we’ll walk you through what umbrella insurance is, what it covers (and doesn’t), who needs it, and why it’s one of the smartest homeowner protections out there — especially in today’s high-cost legal landscape.

What Is Umbrella Insurance?

Umbrella insurance is personal liability coverage that kicks in when your standard insurance runs out. It’s not a standalone policy — it stacks on top of your homeowners, auto, or renters insurance to cover bigger claims and legal costs.

It also protects you from some risks that your other policies may not cover at all — like being sued for libel, slander, or false arrest. For instance, if you’re sued for something you posted online that’s considered defamatory, umbrella insurance could help cover your legal costs.

Quick definition: Umbrella insurance is extra liability coverage that goes beyond the limits of your existing home or auto policy, protecting your assets and future earnings if you’re held responsible for an expensive accident or lawsuit.

What Umbrella Insurance Covers

It’s broader than most people realize. A typical umbrella policy covers:

- Injury to others — If someone gets hurt on your property or in a car accident you cause

- Property damage liability — Say your kid damages a neighbor’s fence or your pet wrecks their garden

- Legal defense costs — Even if you’re not found liable, umbrella can cover your lawyer fees

- Personal liability claims — Libel, slander, false arrest, invasion of privacy

- Incidents involving rental properties you own (with proper coverage)

- Liability claims that occur outside the U.S. (often excluded by base policies)

What’s Not Covered

Umbrella insurance doesn’t cover everything. It generally won’t pay for:

- Damage to your own property or belongings

- Business-related liability (unless you’ve added special coverage)

- Contract disputes or professional mistakes

- Intentional harm or criminal behavior

You’ll also need to meet minimum liability coverage on your home and auto policies before you’re eligible to buy umbrella insurance — usually around $250,000 for auto and $300,000 for homeowners.

Who Should Consider Umbrella Insurance?

This isn’t just for high-net-worth households. If you:

- Own a home or rental property

- Have a pool, trampoline, or dog

- Drive often (especially with teen drivers)

- Host guests regularly

- Coach kids’ sports or volunteer with the public

- Post online reviews, blogs, or videos

- Have savings, investments, or retirement accounts to protect

…then you may already be at higher risk of liability lawsuits — even if you don’t think of yourself that way.

Why it matters: Legal settlements can easily exceed $500,000. Without umbrella insurance, you could be forced to pay the difference out of pocket — or worse, liquidate your assets or face wage garnishment.

How Much Coverage Do You Need?

Most umbrella policies start at $1 million in coverage and can go up in $1 million increments.

A simple rule of thumb? Buy enough to cover your net worth — including home equity, savings, investments, and future income.

That might sound like a lot, but in a serious accident, legal fees and damages can add up fast. Some personal finance experts recommend at least $2 million in coverage for most middle-income households.

What Does It Cost?

For the protection it offers, umbrella insurance is surprisingly affordable.

- Typical annual premium: $200–$400 for $1 million in coverage

- Additional millions: About $100–$150 each

That’s often less than a dollar a day — cheaper than your morning coffee. Premiums are rising slightly due to inflation and higher court settlements — but it still offers some of the best value in insurance today.

Pro Tip

Some everyday activities — like posting on social media, owning rental property, or volunteering with youth programs — carry unexpected liability risks. Umbrella insurance can quietly shield you from financial fallout most people don’t see coming.

How to Buy Umbrella Insurance

You’ll need to have enough base liability coverage first (check your policy limits — typically $250K for auto and $300K for homeowners).

Once you meet that threshold, most insurance companies will let you add umbrella coverage as a rider to your existing policy — often with a multi-policy discount.

Steps to take:

- Review your current liability coverage (auto and home)

- Ask your insurer about umbrella policy options and limits

- Get quotes from other providers to compare — you don’t always need to bundle

Bottom Line for Homeowners

Umbrella insurance fills a critical gap in your protection — one that becomes more important as medical costs, legal settlements, and litigation risks grow.

For less than a dollar a day, it can help you protect everything you’ve built, from your home to your retirement savings. And in the world we live in? That peace of mind is worth more than ever.

Explore More with AHA

- Use the AHA Insurance Advisor to review your liability protection (Coming Soon)

- Learn more in our Homeowners Insurance Coverage Essentials guide

- Need to file a claim? Check out our guide on How to Handle Home Insurance Claims the Right Way