That sleek new thermostat on your wall or the leak sensor under your sink might be doing more than just protecting your comfort and safety — it could be saving you money, too. Across the country, utilities and insurance companies are quietly offering rebates and incentives to homeowners who install certain smart devices. The catch? Many people don’t realize these programs exist or assume every “smart” gadget qualifies. Let’s dig into what really counts, where to find the savings, what skeptics should know, and how to avoid common pitfalls.

The Smart Devices That Actually Pay You Back

When smart home savings programs first appeared, they focused almost exclusively on smart thermostats. Utilities liked them because they could help balance demand during peak hours, and homeowners liked the lower energy bills. Today, the menu of qualifying devices has expanded:

💡 Remember: Qualification depends on recognized standards like ENERGY STAR certification or insurer-approved monitoring requirements.

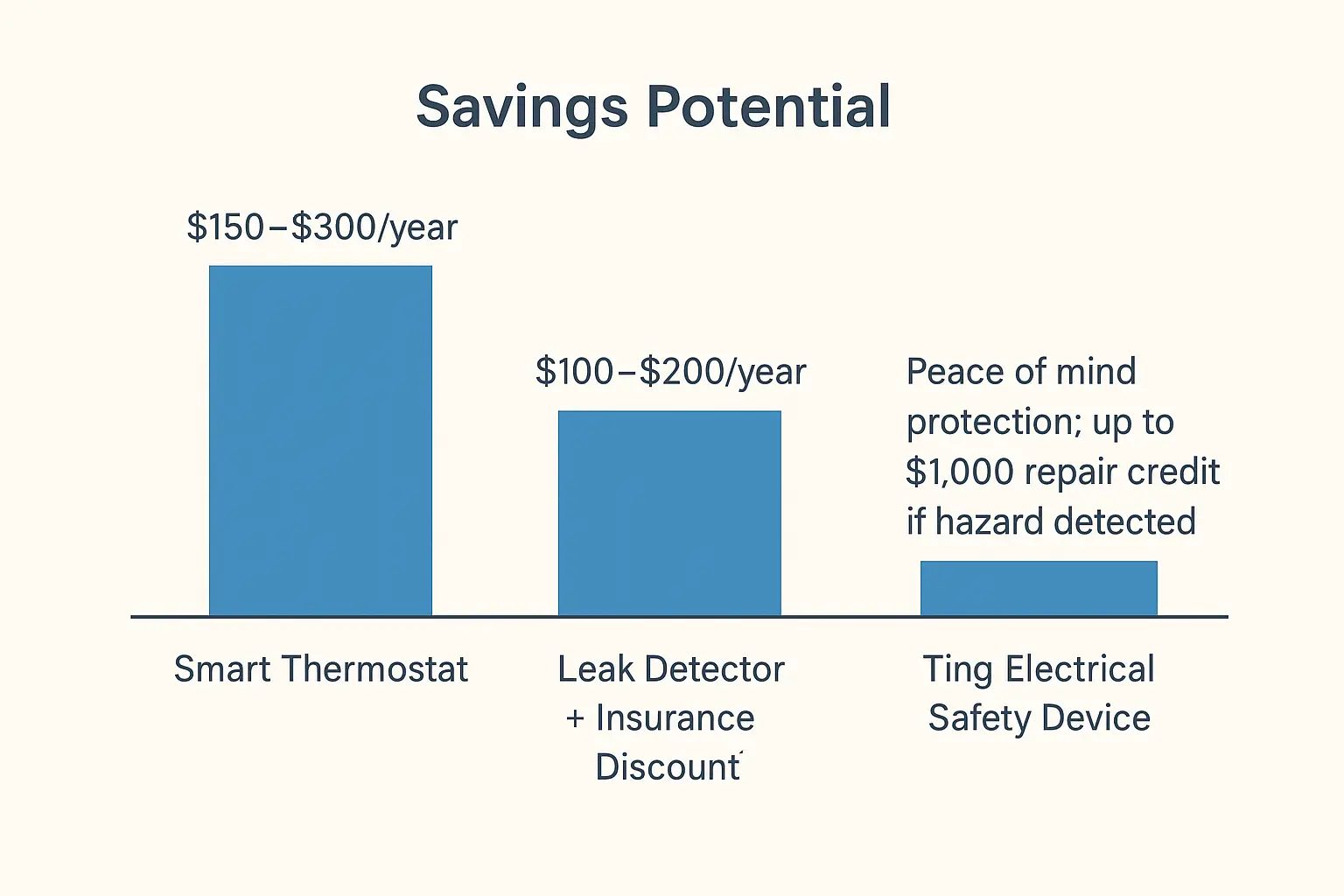

- Smart Thermostats: Rebates up to $150 are common, especially for ENERGY STAR® certified models. Annual energy savings often range from $150 to $300, meaning payback within two years.

- Leak Detectors with Shut-Off Valves: These can prevent thousands of dollars in water damage. Some insurers offer 5–8% premium reductions for homes with automatic shut-off systems.

- Smart Smoke and CO Detectors: By lowering fire risk, insurers may cut premiums by 2–5%.

- Smart Security Systems: Professionally monitored setups can reduce theft-related insurance costs, with discounts ranging from $50 to $200 annually depending on your carrier.

- Ting Electrical Fire Prevention Device: Offered free by some insurers like State Farm, Erie, and Westfield, Ting plugs into an outlet and monitors for hidden electrical hazards that could cause fires. While it may not currently earn you a direct discount on your premium, the device itself and monitoring service are often provided at no cost — and it includes up to $1,000 in repair credits to fix electrical issues it detects. The true benefit is peace of mind protection, with potential savings if Ting catches a wiring hazard before it leads to major damage.

Where to Find Smart Home Savings in Your Area

The search for smart home savings often starts with your local utility company, which may offer rebates for thermostats, EV chargers, or even smart appliances. The Database of State Incentives for Renewables & Efficiency (DSIRE) is another valuable resource, compiling programs by state. Energy.gov also provides national-level incentive information.

For a faster, tailored option, AHA members can use the AHA SmartSaver tool to identify eligible upgrades by ZIP code and estimate the savings they bring.

Insurance Perks: The Overlooked Smart Home Benefit

Insurers have started to recognize the value of prevention. A leak sensor that cuts off water can save thousands in claims. A smart smoke detector can mean the difference between a scare and a total loss. Security systems reduce break-in risks. Insurers reward all of these with discounts that can reach 10 percent.

Consider this example: A homeowner paying $1,800 annually for insurance installs a leak detection system and monitored smoke detectors. With an 8% combined discount, that’s a $144 yearly savings — enough to offset the device costs within two years, while continuing to deliver protection and savings long-term.

And even when discounts don’t apply — as in the case of Ting — the benefit is still very real. Getting a free device and monitoring service worth hundreds of dollars each year, plus $1,000 toward electrical repairs if a hazard is found, reduces risk and provides financial relief most homeowners would otherwise pay out of pocket.

Real-World Save Example: In Brookeville, Ohio, Ting alerted homeowner Mindy to an electrical hazard in her dryer circuit. The wire had corroded and was arcing — a condition that could have sparked a fire. An electrician made repairs using Ting’s $1,000 repair credit, preventing thousands in potential damage. (Whisker Labs)

Industry-wide, Ting’s results are also measurable. A study by the Insurance Information Institute found that homes with Ting experienced a 63% drop in non-catastrophic fire claims and an average financial benefit of about $81 per home per year by year three. (iii.org)

But savings are not automatic. You’ll need receipts, certification, and sometimes proof of professional installation. The AHA Insurance Advisor helps homeowners see which smart devices may qualify for savings under their current coverage.

For the Skeptics: Are Smart Devices Really Worth It?

Some homeowners hesitate — and with good reason. Let’s take the top three concerns head-on.

“Aren’t these devices expensive?”

Yes, upfront costs can run higher than standard models. A smart thermostat may cost $150–$250 versus $40 for a basic one. But with rebates and $150–$300 in yearly savings, it can pay for itself in under two years — and continue saving after. Leak detectors are often under $100, and paired with insurance discounts, they can return their cost several times over.

“What about privacy? I don’t want my home data exposed.”

Privacy is a valid concern. Devices that connect with utilities or insurers may collect usage data, but typically only operational information (like temperature settings or leak alerts). Choosing reputable brands, enabling security features, and reviewing data-sharing policies keeps you in control. Most programs only require proof of installation, not continuous data sharing.

“Do they really save money?”

Yes — but savings depend on proper setup and usage. Smart thermostats programmed and connected to demand response programs show real reductions. Leak sensors don’t trim utility bills, but they can prevent $10,000–$20,000 in water damage, while also earning insurance discounts. Even modest premium reductions (say $100 annually) add up to $1,000 over a decade. Devices like Ting aren’t about recurring annual savings. Instead, think of them as an added safety net: peace of mind protection that may provide up to $1,000 in repair credits if a hazard is detected. The real benefit is in preventing catastrophic fire losses, which could cost tens of thousands of dollars.

In short: smart devices combine smaller, steady savings with the potential to avoid catastrophic costs — a powerful financial one-two punch.

Pitfalls and Fine Print

It’s easy to assume that any device with Wi-Fi qualifies for savings, but that’s rarely true. Some rebates require pre-registration, while others exclude self-installed devices unless monitored. Subscription fees can erode savings. And missed deadlines — sometimes as short as 30 days after purchase — can leave money on the table.

⚠️ Watch-Out: Don’t assume the label “smart” equals savings. Always confirm with your utility or insurer before buying.

Devices That Save vs. Devices That Protect

Not all smart devices deliver savings in the same way. Here’s how to think about them:

- Devices That Save Money Directly: Smart thermostats (lower bills + rebates), security systems (insurance savings), monitored detectors (lower premiums).

- Devices That Protect Value: Ting (peace of mind protection, up to $1,000 repair credit if hazard detected), leak sensors (prevent major water damage), smart CO/smoke alarms (protect life and property).

The smartest strategy is blending both — trimming monthly costs while reducing big-ticket risks.

Turning Smart Into Savings

Smart home technology can do more than make life convenient. When paired with the right rebates and insurance incentives, it can lighten your bills and protect your home at the same time. From thermostats that ease strain on the power grid to leak detectors that prevent water disasters — and devices like Ting that quietly protect against hidden electrical fires — the right technology delivers tangible value.

Before you buy, check your local utility, explore DSIRE, and review your insurance policy. Better yet, use the AHA SmartSaver and Insurance Advisor to see exactly how your upgrades can pay you back. Because in the end, the smartest device is the one that earns its keep.