You’ve probably seen the scary commercials warning that criminals can steal your home with just a forged piece of paper. But do you really need the services they’re selling? The truth is, protecting yourself is easier — and often free — if you’re willing to invest the time to educate yourself on how to stay on top of your property filings. In this article, we’ll explore what deed theft is, why it’s a threat, and what your real options are to protect yourself.

How Big is the Problem?

Imagine waking up one day to find your name erased from your deed — or worse, your home sold out from under you. Deed theft, also known as title fraud, is a real and rising threat. Crooks forge documents to steal homes or secure fraudulent mortgages, leaving homeowners in chaos.

According to the FBI’s 2024 IC3 Report, there were 9,359 real estate fraud complaints in the U.S., with reported losses totaling $173.6 million. Of those complaints, 1,765 were filed by individuals aged 60 or older, whose losses amounted to $76.3 million.

Seniors represented about 19% of complaints, but they bore nearly 44% of the total losses — highlighting the disproportionate impact on older adults. Even high-profile cases, like the attempted fraudulent sale of Graceland, show that no property is immune. In May 2024, scammers claiming to represent a company called Naussany Investments and Private Lending attempted to auction off Elvis Presley’s iconic Memphis home, alleging Lisa Marie Presley had used the property as collateral for a $3.8 million loan. Court records later showed the documents contained a forged notary signature, and a Tennessee judge ultimately blocked the sale after Presley’s granddaughter, actress Riley Keough, filed suit. The case underscored how criminals target properties tied to deceased or elderly owners and revealed just how easy it is to file fraudulent paperwork under today’s trust-based system.

What is Deed Theft?

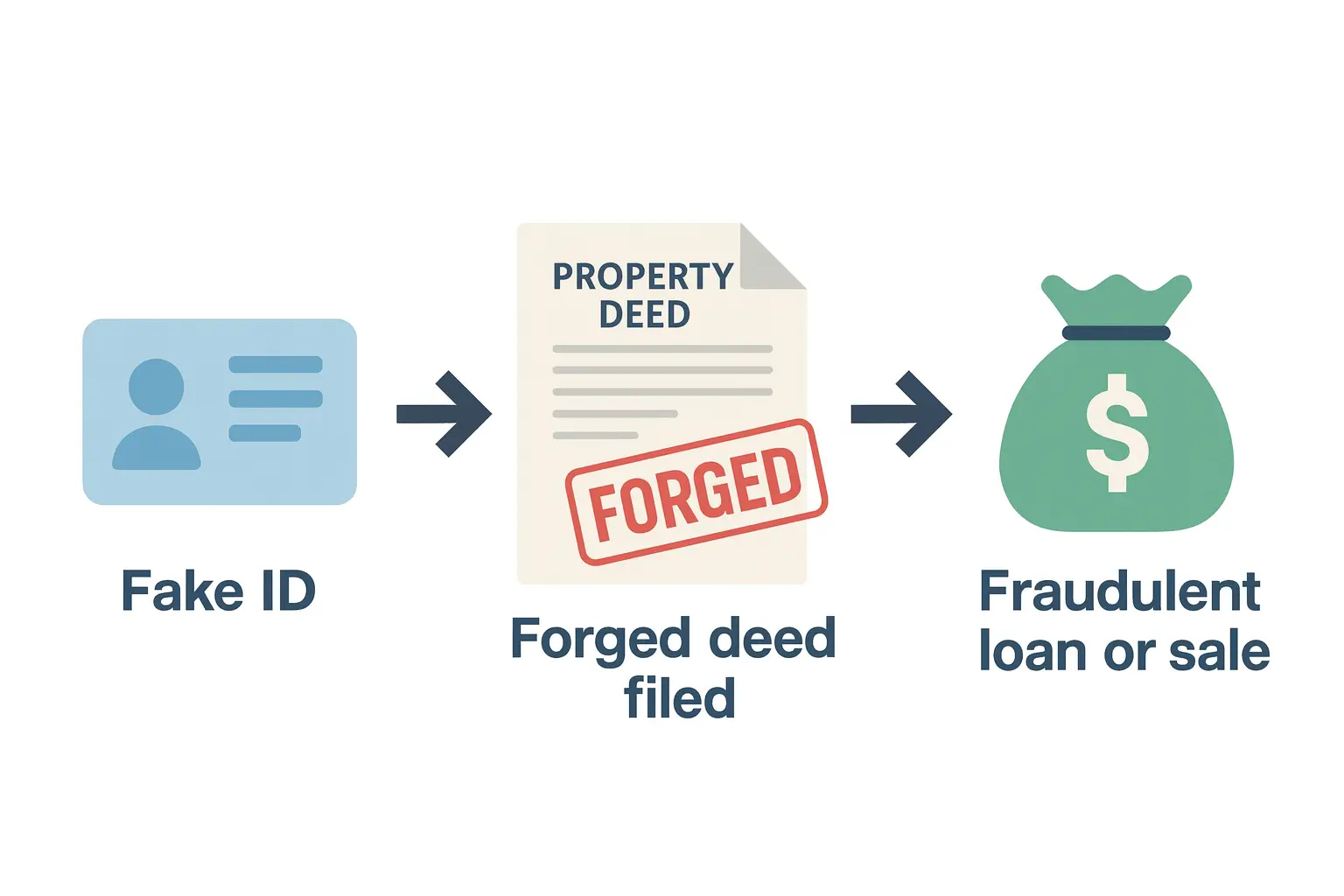

Deed fraud is a type of identity theft. A criminal identifies a target property — often a vacation home, rental, or vacant house — and forges the true owner’s signature on the deed. They may:

- Use stolen personal information to impersonate you.

- Employ fraudulent IDs and counterfeit notary seals.

- Work with unethical notaries to push filings through.

Once the forged deed is recorded at the county recorder’s office, the scammer effectively controls the property — able to rent it, borrow against it, or sell it.

Why It’s So Easy

The U.S. property record system is outdated and trust-based. County clerks generally verify documents for completeness, not authenticity. That means:

- Fraudulent quitclaim deeds can be recorded without much scrutiny.

- Electronic filing in many states makes it easier for criminals to operate remotely.

- Once filed, the fraudulent document becomes part of the public record, creating costly legal disputes.

Learn how some counties are fighting back with free property fraud alert programs.

What Criminals Can Do With Your Deed

Once they gain control of your title, criminals can:

- Illegally rent out your property.

- Open a HELOC (home equity line of credit) in your name.

- Refinance to cash out equity.

- Sell your home to a legitimate buyer and disappear with the profits.

If they default on fraudulent loans, you could face foreclosure, find yourself unable to refinance, or struggle to pass the property to heirs.

Warning Signs of Deed Theft

Look out for these red flags:

- You stop receiving property tax, mortgage, or utility bills.

- Utility usage spikes at a vacant property, or strangers move in.

- Rent payments are redirected to someone else.

- You receive loan statements from an unfamiliar lender.

- You’re suddenly in default or foreclosure on a loan you never took.

👉 Don’t wait until it’s too late. Sign up for early access to AHA Property Defender.

The Myth of “Title Lock”

Despite the name, there is no legal mechanism to actually “lock” your title in the United States. County recorder and clerk offices must accept filings that meet paperwork standards—they do not have the authority to freeze or lock deeds from changes.

What Title Lock companies sell is essentially monitoring: they notify you if a document is recorded against your property. They cannot stop a fraudulent deed or lien from being filed. This is why consumer advocates like Clark Howard stress that freezing your credit and signing up for county alerts are the only true preventive measures.

Is Title Lock a Scam?

Many homeowners wonder if Title Lock is a scam. The answer: it’s not an outright scam, but it is misleading. The name implies your title can be locked and protected, when in reality that’s impossible. What you’re really paying for is a monitoring service—something that counties often provide for free. It won’t prevent fraud, it won’t cover your costs if fraud occurs, and it may give you a false sense of security. That’s why consumer experts urge caution before paying for Title Lock.

What Experts Recommend

Consumer advocates and the FBI recommend:

- Freeze your credit with all three major credit bureaus.

- Register for free county property alerts if available.

- Check your deed status regularly. Many county records are accessible online.

- Monitor your credit reports weekly at AnnualCreditReport.com.

- Consider enhanced title insurance (e.g. ALTA Homeowner’s Policy) if you’re refinancing — it can cover impersonation or forgery.

Real Life Examples

- Boston / FBI Warning — The FBI’s Boston division warned of rising quitclaim deed fraud, where criminals forge documents to record a phony transfer of property ownership. Read more on FBI.gov

- Raleigh, NC — A complete stranger was able to obtain a deed for a $4 million home without the homeowner’s knowledge because the clerk only checks paperwork completeness, not identity. See the ABC11 investigation

- Houston, TX — A couple was ordered to repay over $1.2 million after being accused of stealing nearly 40 properties with forged documents, often targeting inheritance disputes. Coverage in the Houston Chronicle

These stories prove that title fraud isn’t just theoretical — it happens in cities across the country.

Why Seniors Are Most at Risk

Older adults are disproportionately impacted by deed fraud because:

- They’re more likely to own homes outright with high equity.

- They may own vacation or second homes that sit vacant.

- They may be less tech-savvy or less likely to monitor online property records.

- They can miss mail or digital notices, giving criminals more time.

- The emotional and financial impact is greater later in life, with fewer options to recover losses.

For more, see the National Center on Elder Abuse resources on property and deed fraud.

A Smarter Solution: AHA Property Defender (Coming Soon)

At the American Homeowners Association (AHA), we are preparing to launch Property Defender — a new service that goes beyond DIY steps and overpriced monitoring services:

Free Tools (Planned)

- Credit Freeze Wizard – Simple, guided setup.

- County Alert Hub – One-stop access to registry alerts.

- Fraud Education Center – Plain-English guides for prevention and response.

Premium Protection (Defender Plus – Coming Soon)

- Nationwide Monitoring – Title, lien, and mortgage alerts across all 50 states.

- Exemption & Tax Alerts – Stay ahead of homestead and senior exemption expirations.

- Rapid Response Playbook – Pre-filled forms and letters to dispute fraud.

- Concierge Support & Legal Network – Human help when fraud strikes.

👉 Join the waitlist for AHA Property Defender — and be the first to know when we launch.

FAQ: Common Questions About Title Theft and Protection

Can someone really steal my house?

Yes — through deed fraud, a criminal can forge documents to transfer ownership or take out loans against your home. It doesn’t mean you’ll lose your home overnight, but it does create costly legal battles.

Does title insurance protect me from title theft?

No. Title insurance only protects against past defects in ownership at the time you bought your home. It doesn’t cover fraud that occurs afterward.

Is Title Lock a scam?

Not exactly, but it is misleading. There’s no way to legally “lock” your title. Title Lock only monitors records and alerts you after changes occur—something many counties already provide for free.

What’s the best protection?

Experts recommend freezing your credit, signing up for free county alerts, checking your property records periodically, and joining the waitlist for AHA Property Defender to combine prevention, monitoring, and guided defense once it launches.

Why are seniors most at risk?

Seniors often own homes outright, making them attractive targets. They may not check online records as often and may miss mail or digital notices. Criminals exploit this by targeting properties with high equity and less frequent oversight.

Bottom Line

- Deed theft is real, but preventable.

- Title Lock isn’t enough — it only alerts you after damage occurs.

- Smart prevention + fast response is key. Freeze your credit, register for free alerts, check your deed status, and join the waitlist for AHA Property Defender to be covered as soon as we launch.

👉 Sign up for early access to AHA Property Defender. Catch risks before they catch you.