Imagine waking up to a $30,000 property tax bill on a home worth just $180,000 — that’s exactly what happened to a suburban Chicago homeowner. Thankfully, local media spotlighted the mistake, and the county reversed the charge.

Scary? Yes. But also common. Realtor.com found that 4 in 10 U.S. homes are likely overassessed. And if you appeal? Homeowners typically save around $539 a year.

Bottom line? Appealing your assessment isn’t just possible — it’s one of the smartest money-saving moves you can make as a homeowner.

Think Your Property Taxes Are Too High?

Grab the free AHA DIY Property Tax Appeal Toolkit — packed with worksheets, templates, and tips to help you challenge your assessment, cut your tax bill, and keep more money in your pocket.

How Property Assessments Work

Your local tax assessor estimates your property’s market value based on recent sales, neighborhood data, and features like square footage and condition. If you’re unfamiliar with how this valuation is calculated or how your home’s value fits into the equation, check out our foundational guide: Homeowner’s Guide to Property Tax Assessments.

The catch? These mass assessments are often off the mark — especially if your home has hidden flaws, hasn’t been updated, or simply doesn’t match the “average” house in your neighborhood.

Why You Might Be Overpaying

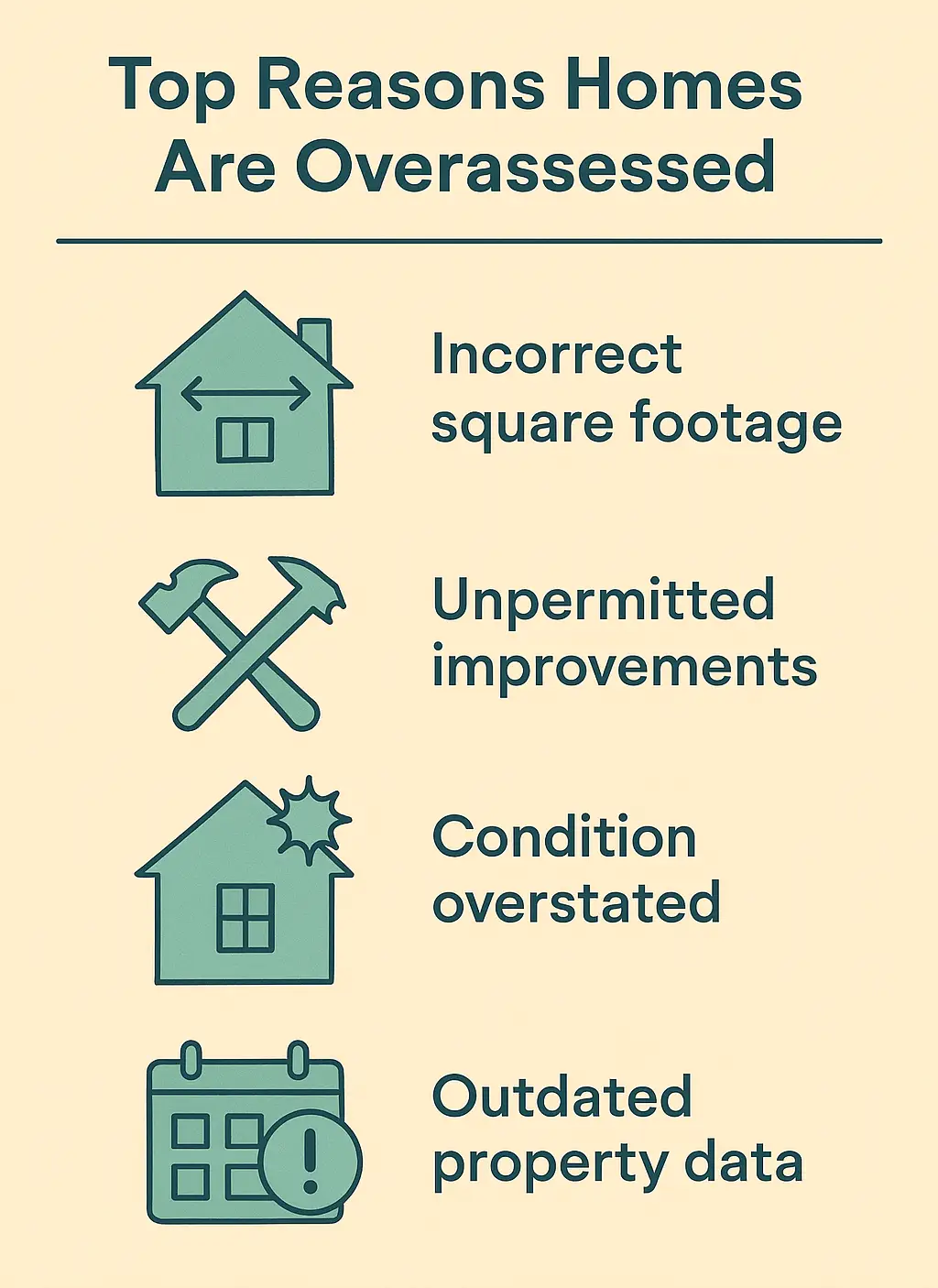

Many assessments rely on bulk data or outdated records. That makes them prone to errors — and opportunities for appeal.

Here are common causes of inflated tax bills:

- Outdated square footage or incorrect room counts

- Overlooking wear and tear or needed repairs

- Comparing your home to newer or remodeled ones nearby

- Local sales data that hasn’t caught up with market shifts

Red Flags That Suggest You May Be Overassessed:

- Your assessed value is higher than similar nearby sales

- You’ve made no upgrades, but your value jumped

- Your home has issues — but the record treats it like it’s pristine

- Obvious errors: wrong number of bathrooms, garage that doesn’t exist, etc.

Pro Tip: Pull your property record and look for discrepancies. Then check recent sales in your neighborhood. It’s often the fastest way to spot if something’s off.

How to Appeal Your Property Tax Assessment

The appeal process typically involves five key steps:

- Reviewing your assessment notice

- Checking your property record for errors

- Gathering sales comps and repair documentation

- Filing a formal appeal

- Potentially attending a hearing

But don’t worry — you don’t have to figure it out alone. Our AHA DIY Property Tax Appeal Kit walks you through each step in detail, with templates, examples, and timelines specific to most localities. If you’re thinking of tackling this yourself, the kit is your best starting point.

Pro Tips for a Successful Appeal

Timing, tone, and evidence matter. Many successful appeals come down to simply being prepared and showing up. Our DIY Property Tax Appeal Kit includes a checklist of best practices — plus common mistakes to avoid — to help boost your odds of success.

When to Call in a Pro (and How AHA Can Help)

If your property is unique, recently renovated, or you’re unsure where to start, a local property tax consultant or real estate attorney can be a smart move. But many homeowners succeed on their own — especially with the right guidance.

That’s why we created the AHA DIY Property Tax Appeal Kit — a free, easy-to-follow resource that walks you through the appeal process step by step. From checking for errors to assembling evidence and filing your appeal, it’s all in there.

Whether you’re doing it yourself or just want to understand your options better, the kit gives you a clear roadmap to potential savings.

Conclusion

Property tax bills can quietly climb year after year. But you’re not powerless. Understanding your assessment — and challenging it when it’s wrong — could save you hundreds or even thousands of dollars annually.

Start by pulling your property record and seeing how your assessed value stacks up to recent sales. Then grab our toolkit and take the next step.