Buying and maintaining a home can come with some hefty costs, but it can also unlock serious tax savings. If you’re a homeowner, you may qualify for a range of tax deductions that renters can’t touch. But here’s the catch: you’ve got to know what qualifies and how to claim it correctly. Whether you’re filing on your own or handing things off to a CPA, understanding your homeowner deductions can help you keep more of your money where it belongs: in your pocket.

Think Your Property Taxes Are Too High?

Grab the free AHA DIY Property Tax Appeal Toolkit — packed with worksheets, templates, and tips to help you challenge your assessment, cut your tax bill, and keep more money in your pocket.

Mortgage Interest Deduction Explained

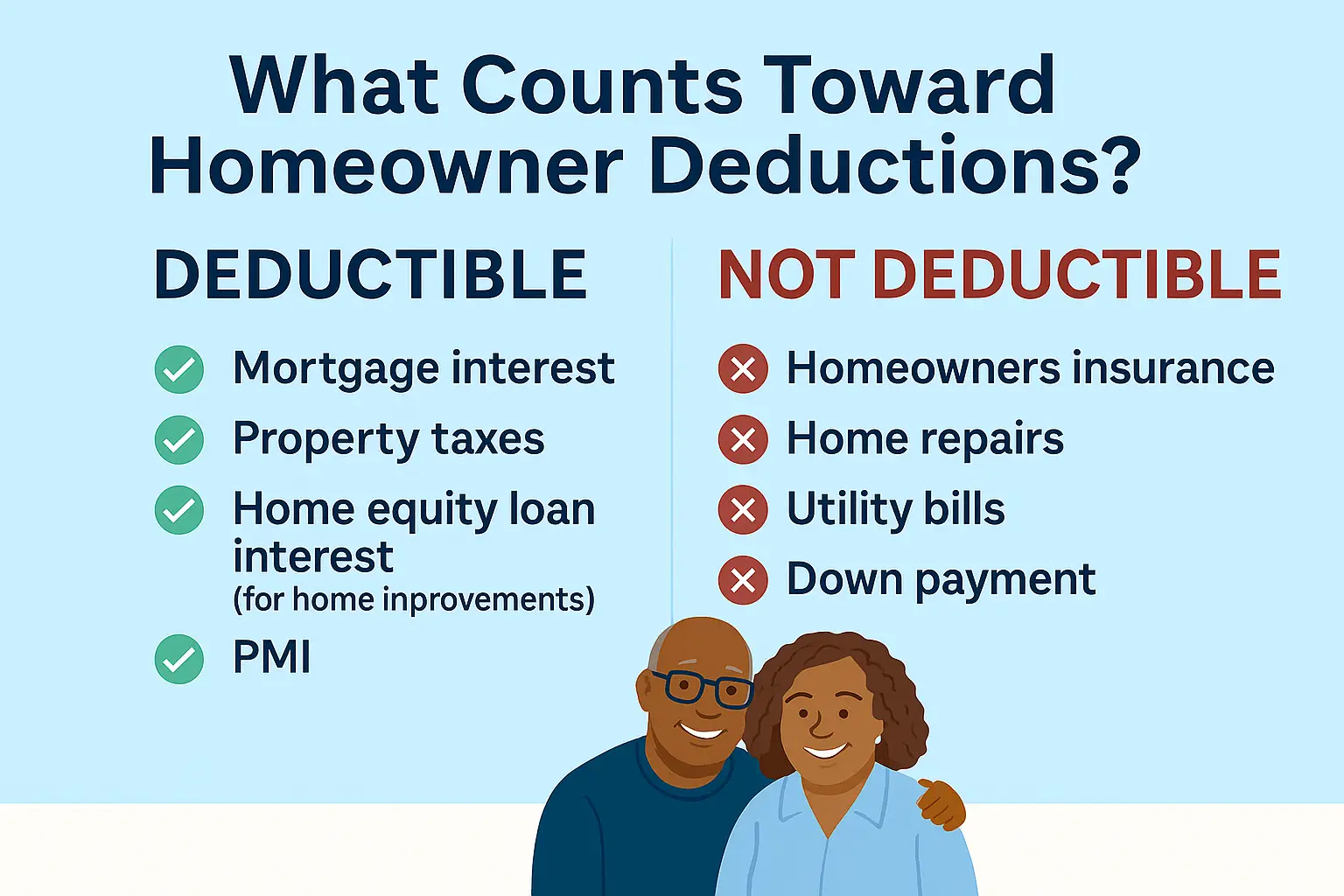

One of the biggest deductions available to homeowners is the mortgage interest deduction. If you took out a loan to buy your home, the interest you pay on that loan is often deductible, as long as it meets IRS criteria. This applies to your primary residence and sometimes a second home. You’ll need to itemize your deductions to claim this, so if you usually take the standard deduction, run the numbers first.

Pro Tip: Watch for Form 1098 from your mortgage lender. It shows exactly how much interest you paid and is key to claiming this deduction.

Property Tax Deduction Rules (SALT Deduction)

Homeowners can also deduct state and local property taxes, within IRS limits. This typically applies as part of the broader State and Local Tax (SALT) deduction. You can choose between deducting state income taxes or state sales taxes, not both, along with your property tax.

Keep good records of what you’ve paid. If your taxes are escrowed in your mortgage, your lender should break it out on your annual statement.

Home Equity Loan Interest Deduction

Interest on a home equity loan or line of credit may be deductible—but only if the funds are used specifically for buying, building, or substantially improving your home. Using the loan for personal expenses like paying off credit cards or taking a vacation won’t qualify.

Energy Efficiency and Green Home Credits

Installing energy-efficient systems—like solar panels, geothermal heat pumps, or high-efficiency HVAC—can sometimes earn tax credits (not to mention lower your utility bills). These programs vary over time, so check with the IRS, the Department of Energy, and your local utility company for up-to-date incentives and eligibility guidelines.

If you’re self-employed and use part of your home exclusively for work, you may qualify for a home office deduction. You can use one of two methods:

- Simplified method: Deduct $5 per square foot, up to 300 square feet.

- Actual expense method: Deduct a portion of mortgage interest, utilities, insurance, repairs, and even depreciation based on the square footage of your office.

Similarly, home modifications made for medical reasons—like installing ramps or widening doorways—may be deductible if they’re medically necessary and meet IRS thresholds.

Capital Gains Exclusion When Selling

If you sell your primary home, you may be able to exclude some or all of the profit from taxes if you meet ownership and use requirements. If you meet the ownership and use tests, you can exclude up to $250,000 (or $500,000 if married filing jointly) of profit from capital gains tax. Keep receipts for major improvements, as these can increase your cost basis and reduce taxable gain.

Other Easy-to-Miss Homeowner Deductions

Mortgage Insurance Premiums (PMI)

If you put down less than 20% when you bought your home, you might be paying for private mortgage insurance (PMI). In some cases, those premiums are deductible if you itemize and meet income requirements. It’s one of the most commonly missed deductions.

Points Paid at Purchase

If you paid points to buy down your mortgage rate when you purchased your home, those may be fully deductible in the year you bought the home—as long as certain IRS conditions are met.

When Home Improvements Count (and Don’t)

Big upgrades like a new kitchen or roof may not qualify for immediate tax deductions, but they can add to your home’s “basis”—potentially reducing your tax bill when you sell. Keep receipts and records.

Repairs (like fixing a leak or patching drywall) generally aren’t deductible unless they’re part of a bigger, qualifying project such as improving a rental space in your home.

Pro Tips for Filing and Recordkeeping

Tools to Help You Calculate Deductions

- IRS Interactive Tax Assistant (irs.gov/ita): Walks you through eligibility questions.

- IRS Publications:

- Publication 530 – Tax Information for Homeowners

- Publication 936 – Home Mortgage Interest Deduction

- Key Forms:

- Form 1098 – Provided by your mortgage lender with annual interest and property tax totals.

- Closing Disclosure and annual statements – Useful for tracking points paid and PMI premiums.

Filing Tips

- Use a tax prep tool or accountant familiar with real estate deductions.

- Save all receipts, invoices, and contractor agreements.

- Keep a digital folder with scanned copies of key documents like Form 1098, energy upgrade invoices, and property tax bills.

- If you’re unsure whether an upgrade qualifies, ask before assuming.

Conclusion: Make Taxes Work for Your Home

Owning a home comes with responsibilities—but it also opens the door to valuable tax benefits. The key is understanding what applies to you and keeping good records throughout the year. Don’t leave money on the table. Review your potential deductions carefully, talk to a tax pro if needed, and make the most of every opportunity to save.