Understanding your home loan is key to making smart financial decisions—whether you’re buying, refinancing, or just managing your mortgage. Here’s a quick guide to help you speak the language of lending.

Types of Home Loans

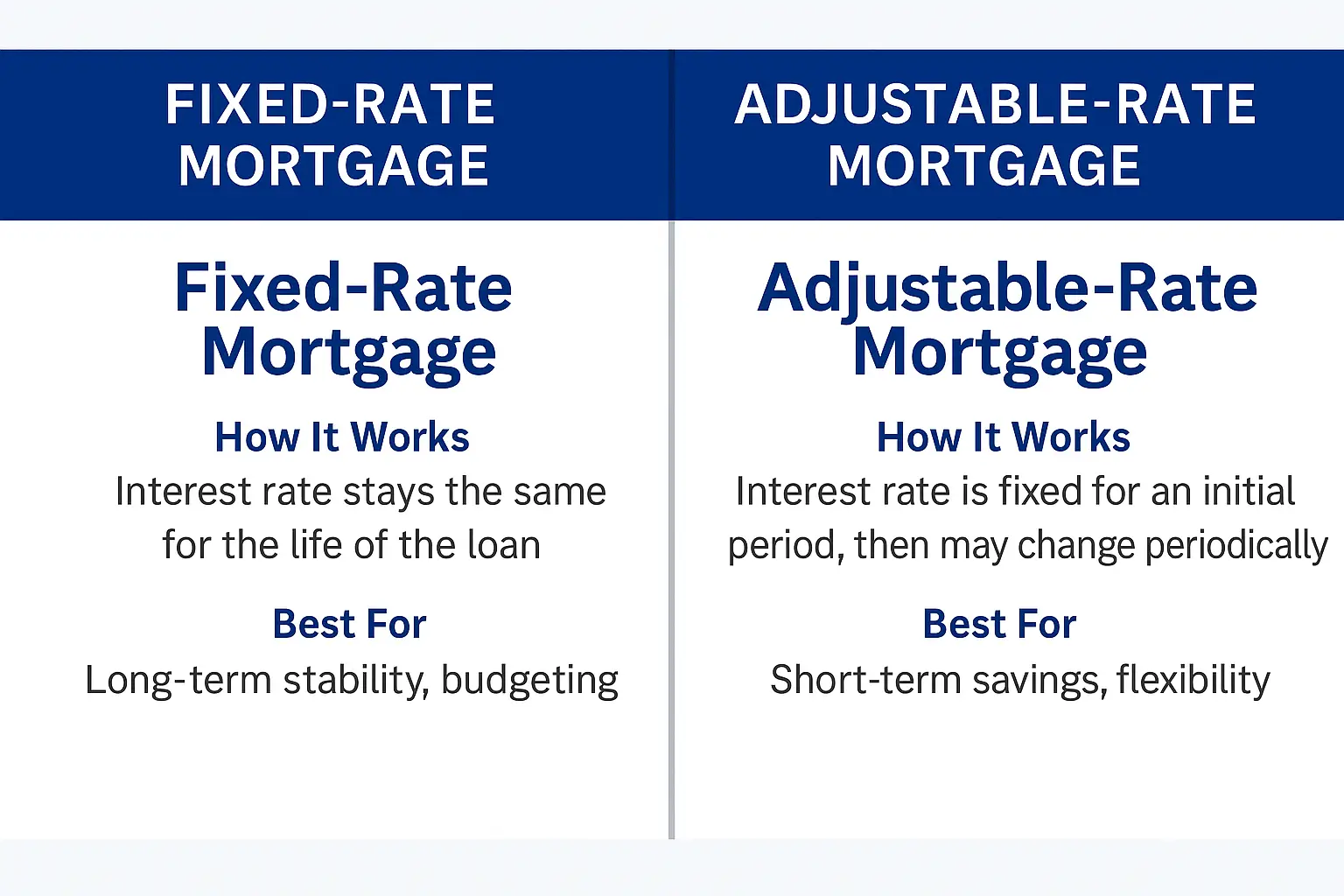

- Fixed-Rate Mortgage: Same interest rate and monthly payment for the life of the loan.

- Adjustable-Rate Mortgage (ARM): Starts lower but may change over time.

- FHA, VA, USDA Loans: Government-backed options with specific benefits and qualifications.

Key Loan Terms Explained

- Principal: The original loan amount

- Interest: The cost of borrowing

- Term: How long you’ll repay (e.g., 15 or 30 years)

- APR: The total yearly cost including fees

- Points: Optional upfront fees paid to reduce your interest rate. One point usually equals 1% of your loan amount. There are origination points (for loan processing) and discount points (to lower your rate).

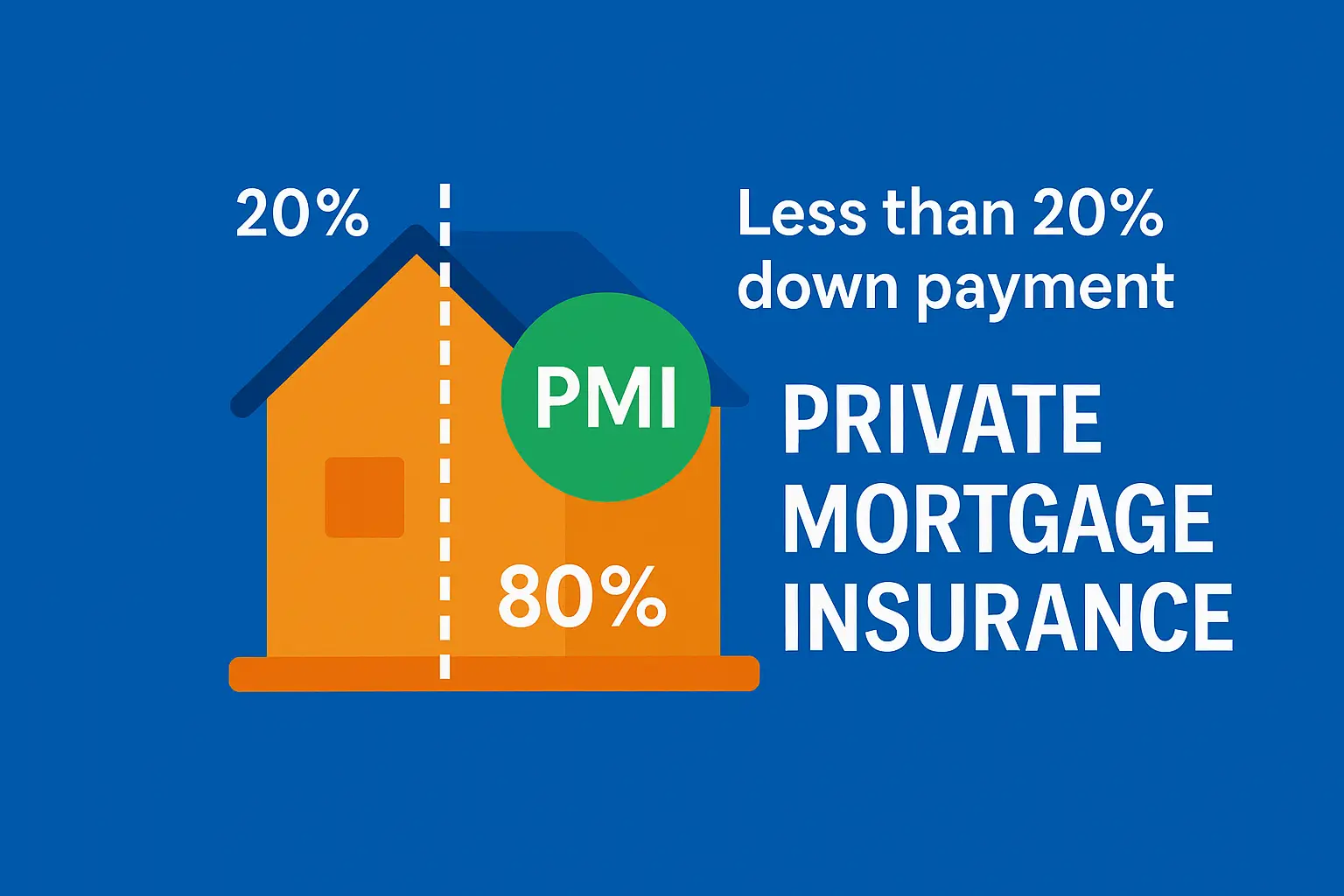

- PMI (Private Mortgage Insurance): Often required if your down payment is less than 20%. Adds to monthly costs but can be canceled when you reach 20% equity.

- Escrow Account: Used to collect and pay property taxes and homeowners insurance. Some lenders require it, but you can request to manage it yourself if allowed by your state and loan type.

- Equity: The portion of your home you truly own—the difference between its market value and the balance of your mortgage. Building equity can open doors to refinancing, better loan terms, or tapping into home equity.

How Much Home Can You Afford?

Determining how much home you can afford is one of the most important first steps before shopping for a property. Most lenders recommend that your monthly housing costs (including mortgage, taxes, and insurance) stay below 28–30% of your gross monthly income. When you factor in other debts, your total debt-to-income ratio should generally be under 43%.

Key factors to consider:

- Your monthly income and debt payments

- Your credit score (affects loan terms and interest rate)

- Available down payment

- Property taxes and homeowner insurance estimates

- HOA fees, if applicable

Pro Tip: Use the 28/36 rule as a quick affordability benchmark:

- No more than 28% of gross income on housing

- No more than 36% on total debt (housing + credit cards, auto loans, etc.)

Explore our tools: Affordability Calculator | Mortgage Calculator | Refinance Calculator

What Does a Mortgage Lender Do?

A mortgage lender helps you finance your home by evaluating your income, credit, and assets; presenting your loan options; and ultimately funding the mortgage. They also handle the underwriting and help coordinate closing.

Watch Out: Don’t just go with the first lender. Compare at least 3 offers to uncover differences in rates, fees, and service.

Should You Manage Escrow Yourself?

Escrow accounts simplify your monthly payments by bundling taxes and insurance, but they also limit control. Some homeowners prefer to handle these bills directly so they can:

- Shop for cheaper insurance

- Avoid escrow shortages or overages

- Time payments more strategically

Pro Tip: If your lender allows it, request an escrow waiver once you have at least 20% equity. Be prepared to show proof of timely payments.

Refinancing vs. Home Equity

- Refinancing: Replaces your current loan with a better one (often for a lower interest rate or monthly payment). Check out our Home Refinancing Guide for more information.

- Home Equity Loan/HELOC: Adds a second loan based on the value you’ve built in your home. Often used for improvements, debt consolidation, or major expenses.

Frequently Asked Questions

How much should I put down?

Aim for at least 20% to avoid PMI, but FHA and other programs offer 3.5% and lower.

Can I pay off my mortgage early?

Usually yes, but check for prepayment penalties—especially with older or subprime loans.

What is an amortization schedule?

It’s a table that breaks down each monthly payment, showing how much goes toward principal and how much is interest.

Pro Tip: Know your loan-to-value ratio, credit score, and debt-to-income ratio. These affect your loan approval and interest rate—and they’re all within your power to improve.

Conclusion

Whether you’re a new buyer or long-time owner, brushing up on home loan basics helps you make smarter mortgage moves, avoid costly missteps, and take more control of your financial future.

Explore More:

- Home Refinancing Guide: Lower Your Mortgage Costs

- First-Time Homebuyer Guide

- AHA Insurance Savings Guide