How Much Should You Save for Home Repairs?

A Simple Guide to Protect Your Budget

Owning a home means more than just mortgage payments. Roof leaks, HVAC breakdowns, plumbing failures, and foundation issues can all cost thousands — sometimes tens of thousands — of dollars.

So how much should you really set aside each year to stay ahead of unexpected repairs?

Use our repair reserve calculator and expert-backed tips to build a smart safety net — no guesswork required.

01.

🤔 Know the Real Costs

See what real homeowners are paying for major repairs like roofs, HVAC systems, and sewer lines — and why the old “1% rule” isn’t always enough.

02.

💵 Estimate Your Reserve

Enter your home’s value and age to get a recommended annual savings target and emergency reserve fund amount.

03.

⚠️ Reduce Your Risk

Learn about insurance riders, smart tech (like water shutoffs), and preventative maintenance that can save you thousands.

How Our Calculator Helps You Plan Smarter

Smarter saving starts with the right numbers

Most budgeting advice stops at “save 1% of your home’s value each year.” That’s a decent rule of thumb, but it doesn’t reflect the real-life costs homeowners face. Our tool looks deeper—factoring in the age of your roof, HVAC, and water heater, plus hidden risks like plumbing, foundation, and extreme weather—so your reserve is sized to your actual home.

- Estimate annual and monthly repair savings tailored to your home.

- See when major systems (roof, HVAC, water heater) are likely to need replacement.

- Add extra protection for foundation, plumbing, or weather-related risks.

- Plan for insurance gaps with a deductible cushion and rider suggestions.

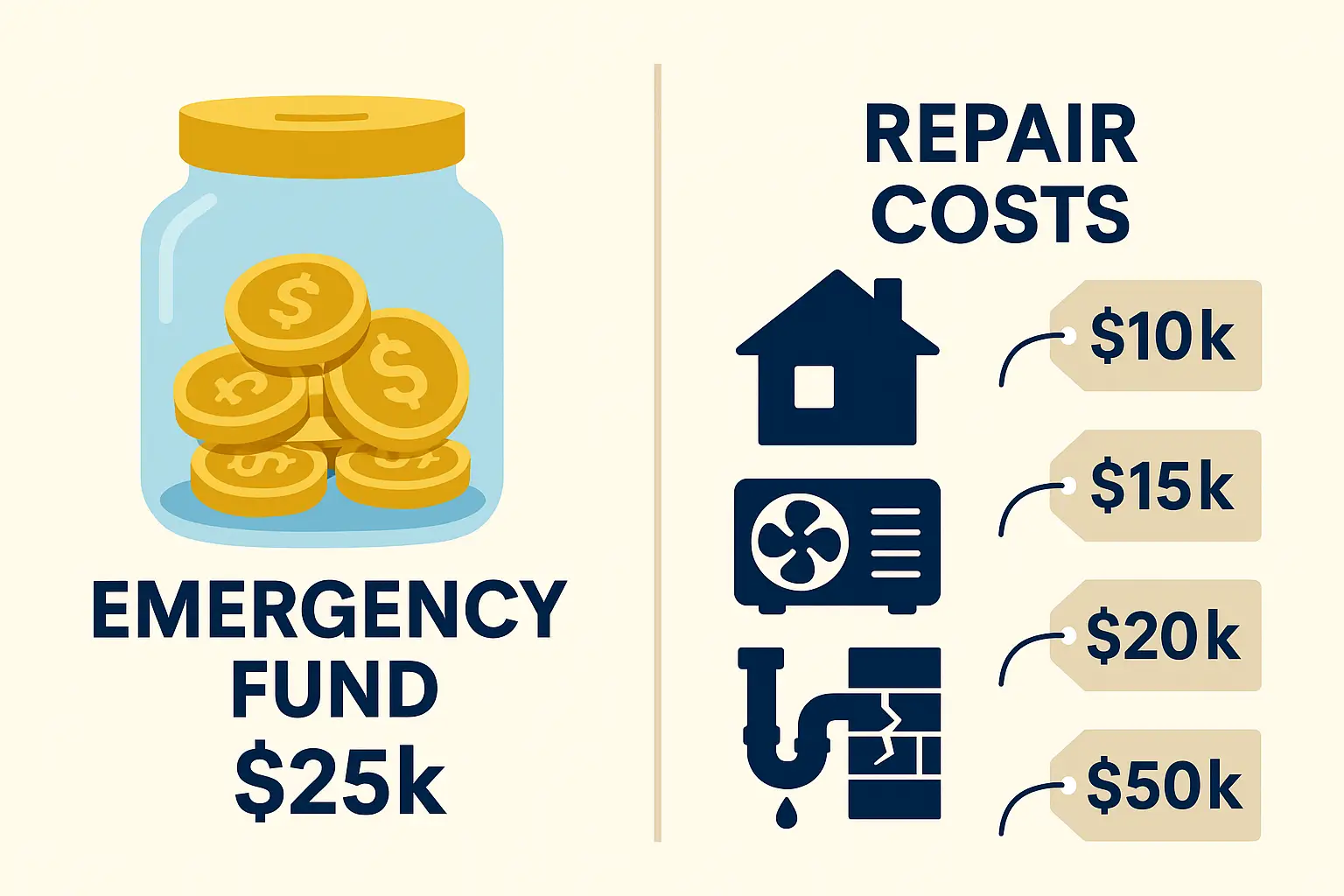

- Avoid being blindsided by $10k–$50k surprises — and stay financially steady.

Home Repair Reserve Calculator

Estimate how much to save each year for repairs — plus an emergency cushion.

What you’ll get: a yearly savings target, a monthly amount, an emergency cushion, and a simple list of big items to plan for.

Step 1 — Enter the value of your home

A ballpark number is fine. This helps size your savings and our HVAC estimate.

Step 2 — How old are the big systems?

Tell us the ages you know. If you’re not sure, a best guess works.

Step 3 — Fine-tune (optional)

Add a few details to personalize the numbers — totally optional.