Thinking about refinancing your mortgage? You’re not alone. With interest rates fluctuating and home values rising in many areas, more homeowners are exploring refinancing as a way to cut costs. But is it always the right move? This home refinancing guide walks you through the key factors to consider, helping you determine if refinancing can truly save you money.

What Is Mortgage Refinancing and How Does It Work?

Home refinancing means replacing your current mortgage with a new one—typically with better terms.. Homeowners usually refinance to get a lower interest rate, reduce monthly payments, switch loan types, or tap into home equity.

Example: If your original loan had a 6% interest rate and you refinance to a 4.5% rate, you could save hundreds each month and tens of thousands over the life of your loan.

There are three main types of home refinancing:

- Rate-and-term refinance: Most common; changes the interest rate, loan term, or both.

- Cash-out refinance: Lets you borrow against your home equity and get cash back. (See our Leveraging Home Equity Strategically guide.)

- Streamline refinance: Offered by some government-backed loans (FHA, VA) with simplified paperwork and fewer requirements.

When Does Home Refinancing Make Financial Sense?

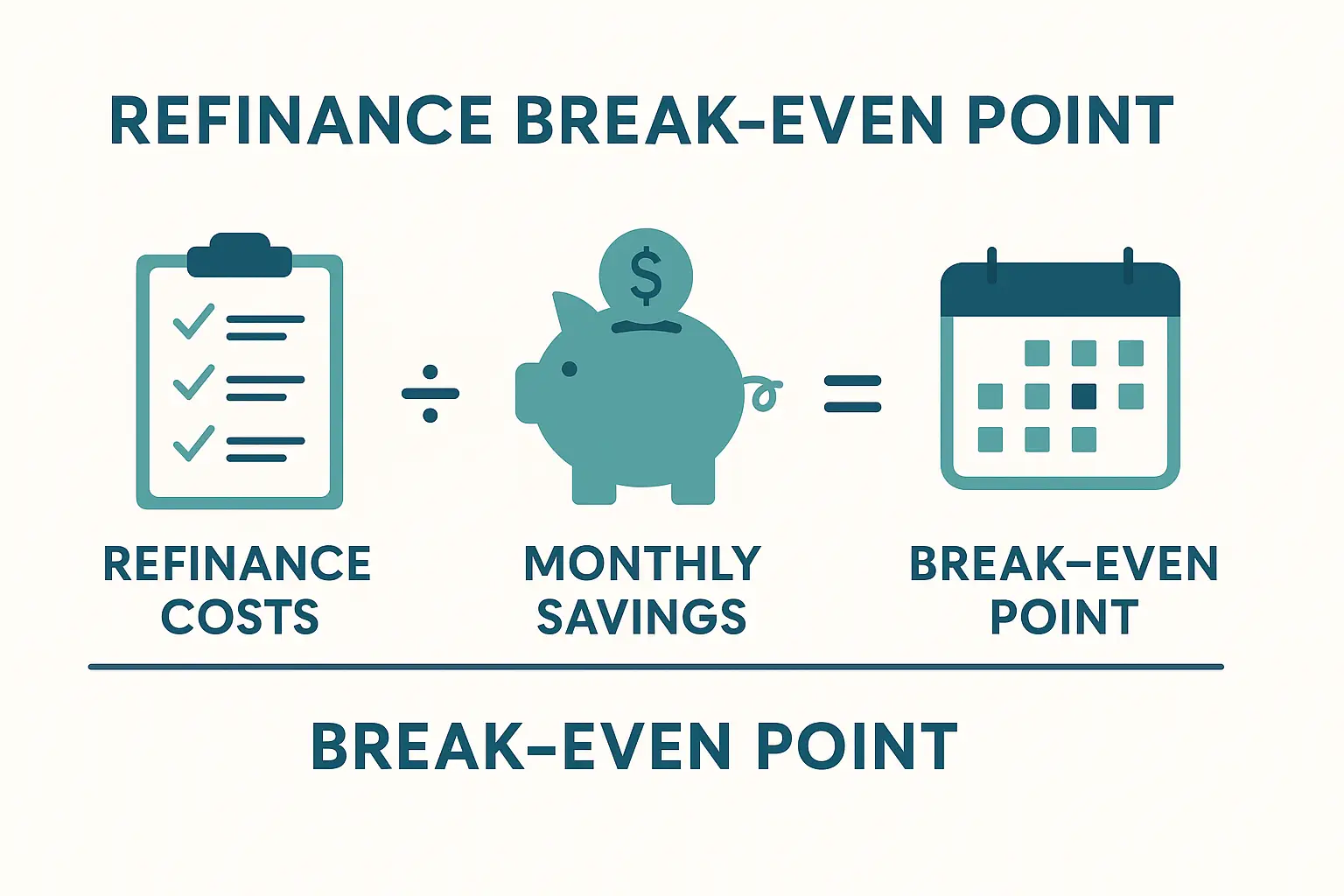

Refinancing isn’t free—you’ll pay closing costs, which average 2% to 5% of the loan amount. That’s why it’s important to evaluate whether home refinancing makes sense for your situation.

Ask yourself:

- Can I lower my interest rate by at least 1%? This is a common benchmark for worthwhile savings.

- Will I stay in the home long enough to break even on closing costs? Use a refinance calculator to estimate your break-even point. (Try our Refinance Break-Even Calculator)

- Has my credit score improved? Better credit means better loan terms. (Check yours at AnnualCreditReport.com)

- Do I need to consolidate debt or fund a major expense? Cash-out refinancing may help, but consider the long-term costs.

Watch Out: Extending your loan term (e.g., going from 20 to 30 years) can lower your monthly payment but may increase total interest paid over time. (Learn more in our Home Loan Basics article or check your home’s affordability)

Steps to a Successful Refinance

To make the most of home refinancing, follow these essential steps.

- Know Your Goals

Are you aiming to lower your payment, pay off your loan faster, or access cash? Your goals shape the loan you need. (Use the AHA Home Budget Tracker to map your financial goals.) - Check Your Credit and Equity

A higher credit score and more home equity improve your refinancing options. Most lenders prefer at least 20% equity. - Shop Multiple Lenders

Rates and fees vary. Compare at least 3 offers to find the best deal. Online mortgage marketplaces can help streamline this. (See the CFPB Rate Shopping Tool)

- Understand the Fees

Refinance closing costs can include application, appraisal, title, and origination fees. Some lenders offer “no-closing-cost” loans by charging a higher rate. - Lock in Your Rate

Rates change daily. If you like an offer, lock it in while completing the paperwork.

Pro Tip: Consider shortening your loan term to 15 years if you can afford higher payments. You’ll pay less interest overall and build equity faster.

Conclusion

Home refinancing can be a powerful money-saving move money-saving move—but only if the math works in your favor. By understanding your goals, comparing offers, and planning for costs, you can decide if it’s the right step for your financial future.

Next Step: Try the AHA Refinance Calculator to estimate your monthly savings and break-even point. It’s the smartest first move you can make.