Understanding What You Can Really Afford—Not Just Qualify For

Buying a home is one of life’s biggest financial steps. It’s exciting—but it can also be overwhelming, especially when you see the numbers a lender says you “qualify” for. That number might be impressive. It might even feel like a green light to go big. But the truth? Just because you can borrow that much doesn’t mean you should.

This guide is here to give you a clear-eyed, real-world perspective—like a conversation with a smart, no-nonsense friend who’s been there. We’ll walk you through what home affordability really means, how to avoid becoming house poor, and how to buy a home that supports your life—not swallows it.

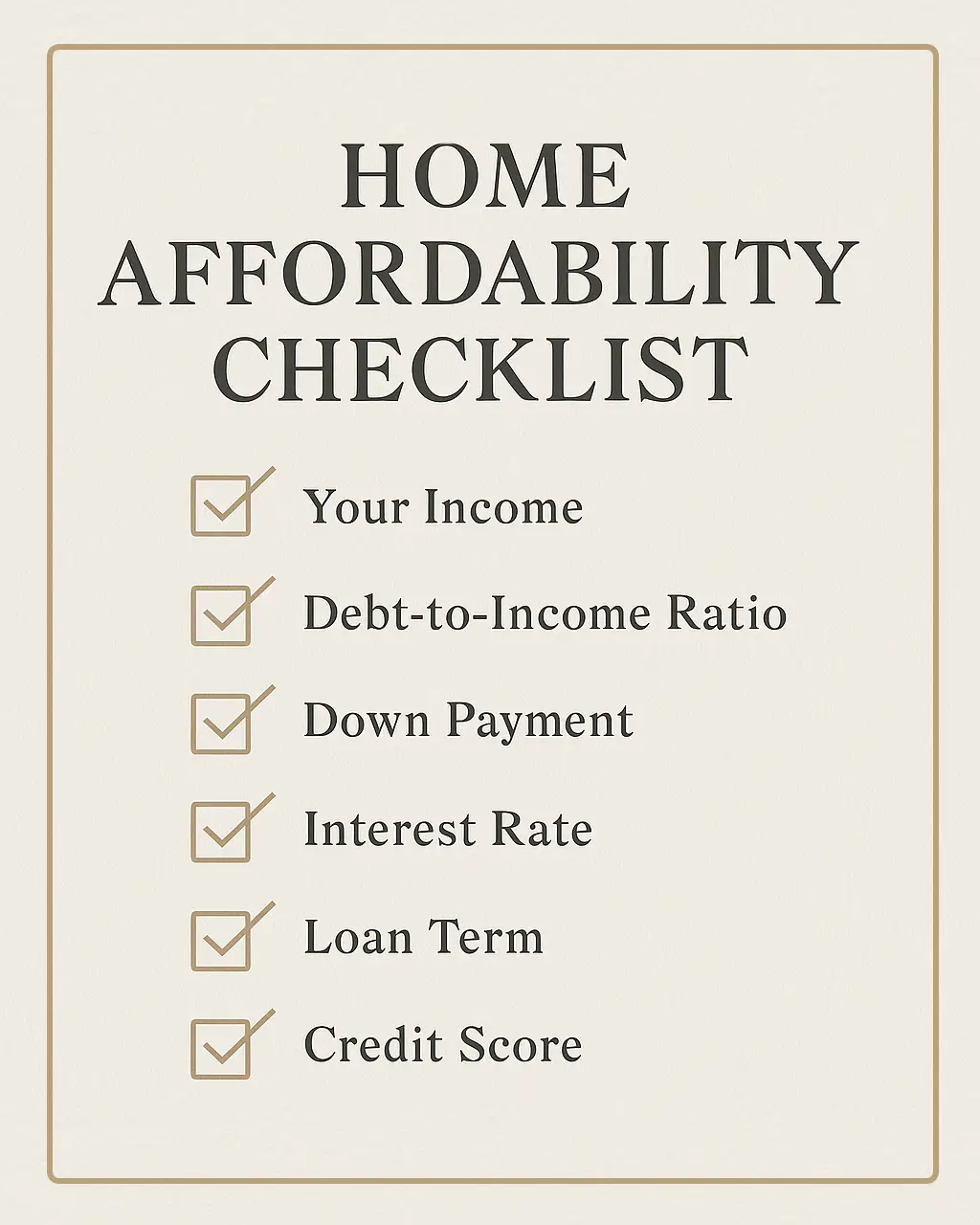

What Really Determines Home Affordability?

You’ve probably heard the terms: “preapproval,” “interest rates,” “down payment.” These are part of the equation, yes—but they’re just the mechanics.

At its heart, affordability is about peace of mind. About not regretting your choice every month when the mortgage is due. So let’s break it down:

- Your Income: Start by listing all consistent sources of income—salary, bonuses, side gigs, alimony, or Social Security benefits. Add them up to get your gross monthly income. Be honest and conservative in your estimates—don’t count irregular side hustle income unless it’s reliable.

- Debt-to-Income Ratio (DTI): Lenders want this under 36%, but staying lower gives you breathing room. Add up your existing monthly debt obligations—car loans, student loans, credit cards, and personal loans. Then divide that by your gross income to see where you stand. A simple spreadsheet or budget tracker app can help you calculate this quickly.

- Down Payment: More money upfront = smaller loan + better rates. Saving 20% of the home’s value is ideal, but even 10–15% gives you more flexibility. If you’re still saving, aim to build both a down payment and a separate emergency fund.

- Interest Rate: Even 1% makes a big difference in your payment. Shop around. Compare lenders. A lower rate can mean the difference between affording a home or being priced out.

- Loan Term: Longer terms lower monthly payments but raise total cost. A 30-year loan is most common, but if you can swing a 15-year loan, you’ll save significantly on interest.

- Credit Score: Higher scores unlock better rates—and more affordable homes. Check your credit reports, pay down balances, and correct any errors before applying.

💡 Pro Tip: Our Affordability Calculator lets you see how each factor impacts your price range.

But the biggest factor? Your goals. Your family, your lifestyle, your tolerance for risk. A smart budget fits your life, not just the bank’s formula.

How Much Should You Spend on a House?

Let’s say it again: Just because you qualify for a number doesn’t mean it’s a good idea to spend it.

It’s tempting to treat preapproval like a shopping limit—especially when your dream home is just a little bit higher. But many homeowners have learned the hard way that stretching for a bigger house often means sacrificing comfort elsewhere—like vacations, savings, or even basic peace of mind.

We don’t want that for you.

Instead of asking “how much house can I get?” ask: What can I comfortably afford—and still sleep at night?

That’s where a clear, simple rule of thumb can help. We’ve blended two trusted formulas into one easy-to-remember affordability guideline designed to keep your housing budget safe, steady, and sustainable.

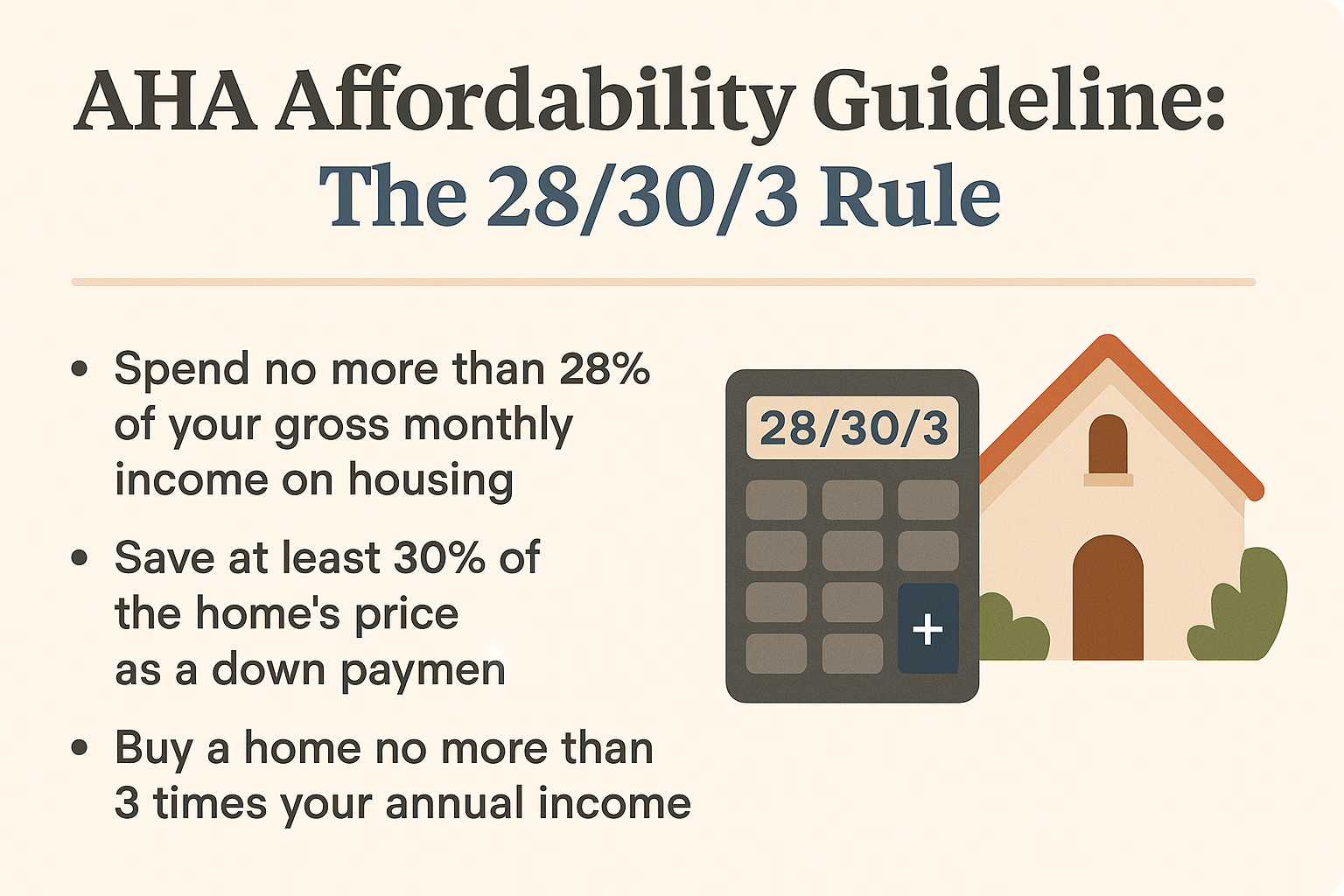

AHA Affordability Guideline: The 28/30/3 Rule

This rule blends the most practical advice into one simple framework:

- 28% — Spend no more than 28% of your gross monthly income on total housing costs (this includes mortgage, property taxes, and homeowners insurance).

- 30% — Aim to save 30% of the home’s purchase price before buying. This covers your down payment, closing costs, and gives you a cushion for unexpected expenses.

- 3x — Don’t buy a home priced at more than 3 times your annual gross income. This keeps your purchase grounded in your actual financial capacity.

Why it Works:

This rule strikes a balance. It keeps your monthly payments in check while making sure you’ve got equity and a cushion. You’ll be prepared not just to buy the home—but to own it responsibly.

🎯 Straight Talk: These guidelines may feel conservative, but they’re designed to keep your home a blessing—not a burden.

Don’t Fall Into the “House Poor” Trap

Owning a home shouldn’t mean giving up vacations, date nights, or the ability to fix your car when it breaks down. That’s the danger of stretching too far.

Here’s how to avoid it:

- Build a cushion: Set aside 3–6 months of living expenses in an emergency fund. This safety net is critical when the unexpected hits.

- Aim under budget: If you can “afford” $2,500/month, look for $2,000. That’s your margin of safety.

- Think beyond the mortgage: Include estimates for property taxes, homeowners insurance, HOA fees, utility bills, and repairs. Create a realistic monthly budget before you buy.

🏡 A beautiful home is no gift if it costs you your financial peace.

What If You Don’t Have 20% Down?

Not everyone can walk into homeownership with a 20% down payment—and that’s okay. There are still smart ways to get started:

- First-time homebuyer programs: Look for local, state, or federal programs that offer reduced down payments, grants, or closing cost assistance.

- FHA Loans: Require as little as 3.5% down. These can be great for buyers with moderate credit and limited savings.

- House Hacking: Buy a duplex, triplex, or a single-family home with a basement apartment. Live in one unit, rent out the other(s) to offset your mortgage.

- Roommates: Buy a home with extra bedrooms and rent them out. This can drastically reduce your housing expense.

- Family Gifts or Shared Equity: Some buyers receive help from parents or share ownership with a family member or friend.

- Accelerated Savings Plan: Cut expenses, pick up extra shifts, or use tax refunds or bonuses to build your down payment fund faster. Open a dedicated savings account and automate deposits.

💡 Pro Tip: Even if you start with a low down payment, make a plan to build equity quickly. Extra payments on principal can shorten your loan and reduce interest costs.

The Full Cost of Homeownership

Your mortgage is only the beginning. Be ready for:

- Property Taxes: Usually 1–2% of your home’s value per year. Research local rates and factor in possible increases.

- Homeowners Insurance: Often $800–$2,000 annually, depending on location, home value, and coverage.

- PMI: Required if you put down less than 20%. Estimate this as an extra $50–$150/month.

- Maintenance: Budget 1–3% of the home’s value each year for repairs and upkeep. Older homes may require more.

- HOA Fees: These can range from $100–$500/month or more. Ask in advance and read the HOA’s rules.

- Utilities: Bigger homes mean bigger bills—especially for heating and cooling.

💡 Watch Out: Even if your lender escrows taxes and insurance, these can change annually—surprise increases are common.

What Is Escrow—and Can You Opt Out?

Escrow is when your lender collects extra money monthly to cover taxes and insurance. It’s convenient, but not always required.

You might opt out if:

- You have great credit

- You’re putting 20%+ down

- You prefer managing large bills on your own

Still, for many first-time buyers, escrow is a helpful way to budget.

What Is PMI—and How to Avoid It

Private Mortgage Insurance (PMI) protects your lender—not you. It’s required with down payments under 20%.

- Typical Cost: 0.5%–1% of your loan annually

To avoid PMI:

- Put 20% down

- Use a VA or USDA loan (if eligible)

- Consider lender-paid PMI (watch out—it often comes with a higher interest rate)

So, What Can You Afford?

Before falling in love with a house, get clear on your numbers:

- Calculate your income and debts

Start with your monthly pre-tax income. Then tally up monthly debt payments: car loans, credit cards, student loans. Use these to calculate your DTI. If you don’t know where to begin, grab your last two pay stubs and a recent credit card statement or loan summary. - Estimate your down payment

Look at your savings. Can you comfortably cover 10–20% down plus closing costs and still have an emergency fund left over? If not, research first-time buyer programs or house hacking strategies. - Use our Affordability Calculator

Plug in your numbers to see a recommended price range based on your inputs. - Pressure test it

Imagine a job loss, a surprise expense, or needing to care for a family member. Would your housing costs still feel manageable? - Talk to a pro

A financial advisor or mortgage specialist can help you weigh options and make a plan that fits your bigger goals.

🎯 Remember: A good house fits your life. A great one fits your future.

Use Our Affordability Calculator

Quick Rules Recap:

- 28/30/3 Rule: 28% of income for housing; 30% of home price saved; don’t exceed 3x annual incom

Use these as guides—not limits. Your life, your plan.