If you opened your latest home insurance renewal and nearly dropped your coffee, you’re not alone. Across the U.S., homeowners are seeing their premiums jump—sometimes by hundreds or even thousands of dollars. So what gives? Why did your home insurance go up, even if you haven’t filed a claim or changed anything?

Let’s break it down—what’s happening, what’s reasonable, and how to protect yourself without taking on unnecessary risk.

Is It Just Me? Why Everyone’s Rates Are Rising

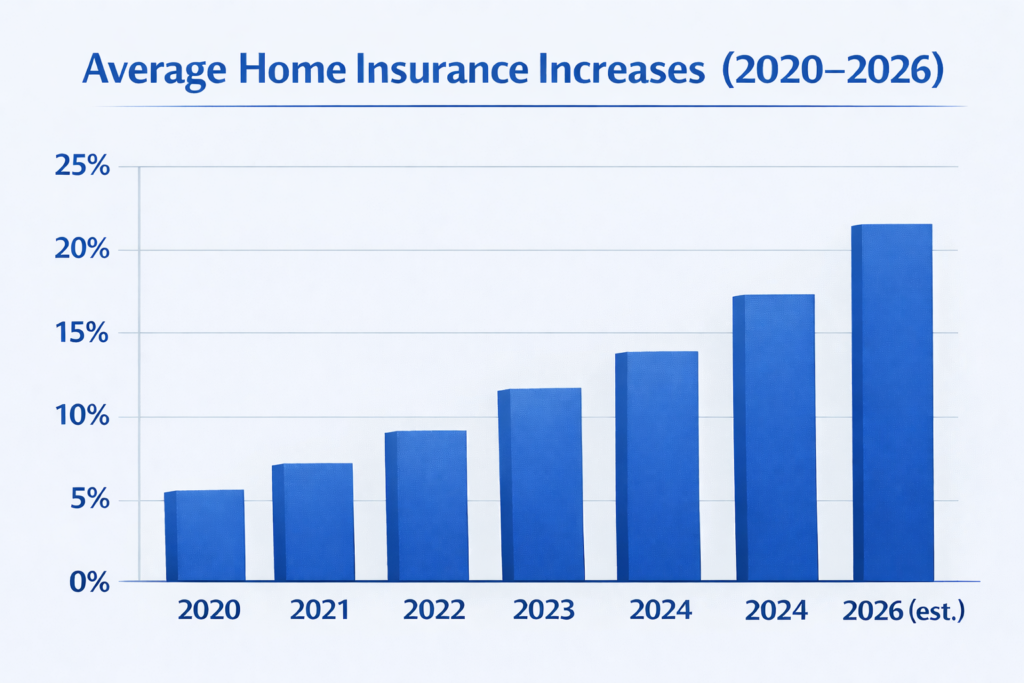

Nope, it’s not just you. From 2023 into 2026, home insurance rates have climbed dramatically. Most U.S. homeowners have seen annual increases between 6% and 10%, and in some areas—especially those hit by severe weather or insurer exits—hikes of 15% to 30% or more are common, according to industry data from S&P Global Market Intelligence.

5 Reasons Your Premium May Have Jumped

1. Rebuilding Costs Are Still Climbing

Insurance covers what it would cost to rebuild your home today. With inflation, labor shortages, and supply chain challenges, that number keeps rising.

2. Your Region’s Risk Profile Worsened

A single wildfire season, flood, or hurricane—even in a nearby county—can raise rates for everyone in the region.

3. Insurer Adjustments and Market Retreats

Insurers are pulling out of risky areas or limiting new policies. Less competition = higher premiums for the rest of us.

4. Credit Score or Claims History Changed

Even a minor dip in your credit score or a single small claim could cause a rate hike.

5. Quiet Policy Changes You Missed

Auto-added endorsements, updated replacement cost calculations, or revised deductibles may have crept in.

🛠️ Pro Tip: Your home doesn’t need to change for your rate to rise. If your neighborhood becomes riskier, or your insurer updates how they assess risk, you’ll likely see it in your renewal notice.

What’s a “Reasonable” Increase?

There’s no perfect number, but here’s a general guide:

- 5–10% per year = Typical, especially if it aligns with inflation or rebuilding costs.

- 15–30%+ = Worth investigating. Ask for a breakdown and compare quotes if it feels too steep.

📌 Watch Out: If you haven’t made a claim or changed your policy but your rate jumped >20%, don’t just accept it—ask questions.

How to Lower Your Premium—Without Risking a Big Loss

These are the most effective ways to bring your rate down safely:

✅ Raise Your Deductible (Smartly)

Increasing from $500 to $1,000 can cut your premium 10–25%. Choose a deductible you can afford in an emergency—ideally around 1% of your home’s replacement cost.

✅ Bundle Policies

Combining home and auto coverage with one insurer can earn you 10–20% off.

✅ Ask for Every Available Discount

Don’t assume discounts are applied automatically. Ask your agent about:

- Claims-free history

- New roof or storm-resistant upgrades

- Smart home devices (like leak detectors or monitored alarms)

- Loyalty or alumni association discounts

- Paying in full or paperless billing options

✅ Improve Your Home’s Risk Profile

Install fire sprinklers, water shut-off systems, or impact-resistant windows. These upgrades can reduce your risk—and your rate.

✅ Avoid Filing Small Claims

For minor repairs, it’s often smarter to pay out of pocket. Too many claims, even small ones, can lead to long-term premium hikes.

✅ Shop Around Every 2–3 Years

Different insurers evaluate risk differently. You may find comparable coverage for less just by getting quotes elsewhere.

🗣️ Want help starting the conversation?

Download the AHA Insurance Savings Call Guide to ask smarter questions and uncover savings—without giving up critical coverage.

You’re Not Powerless

Yes, rates are rising—but that doesn’t mean you have to take it lying down. With a little digging and the right questions, you can often reduce your premium without reducing your protection.

🧰 Get help from the AHA Insurance Advisor (Coming Soon) to compare policies, spot hidden savings, and stay covered with confidence.