Every year, millions of U.S. homeowners overpay their property taxes without realizing they qualify for a homestead exemption. If you own and live in your home as your primary residence, this simple tax break could save you hundreds — sometimes thousands — of dollars each year. But how does it work, who qualifies, and how do you apply?

Let’s break it down so you don’t leave money on the table.

What Is a Homestead Exemption?

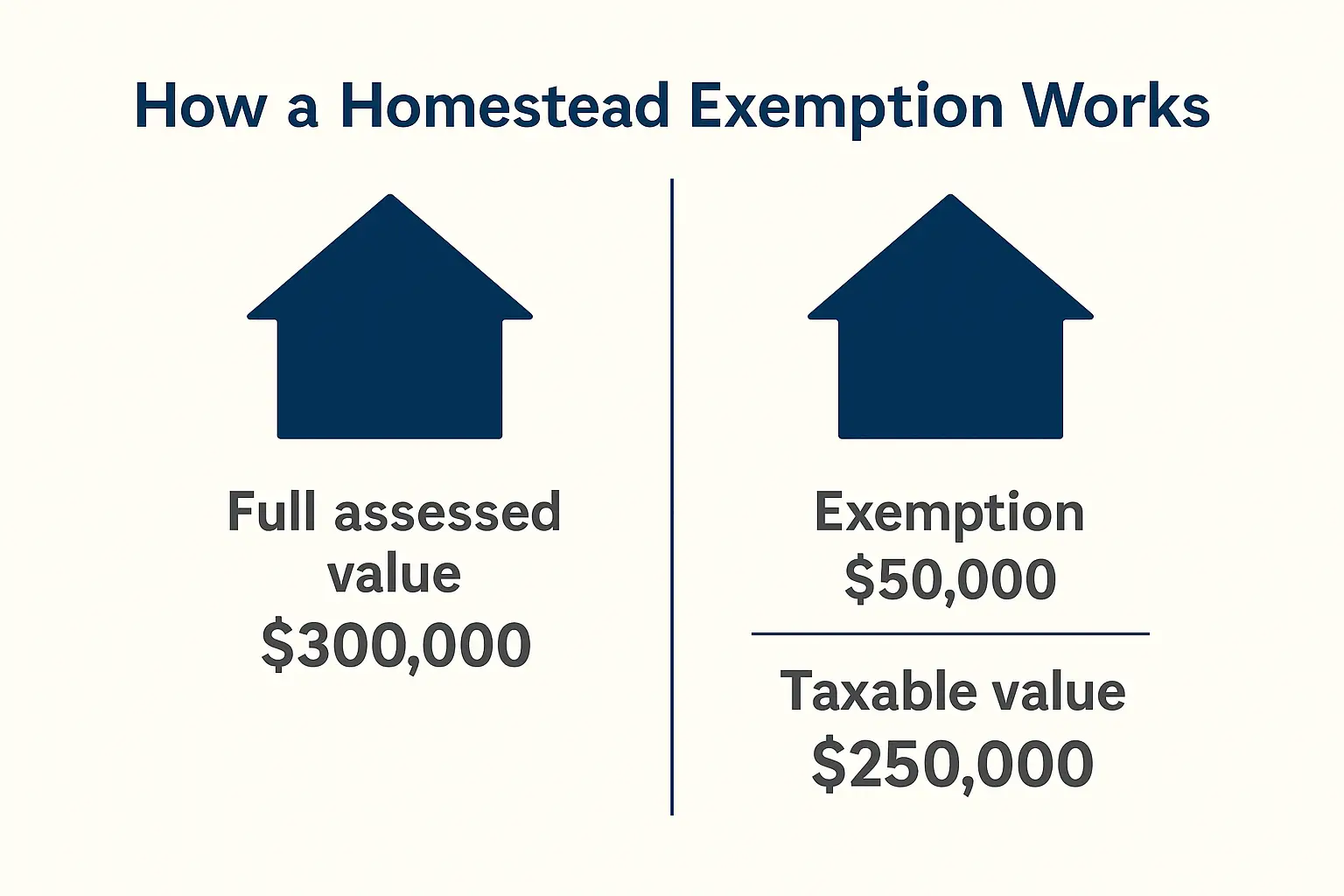

A homestead exemption reduces the taxable value of your home — and that means a smaller property tax bill. Your local government calculates your taxes based on your home’s assessed value. When an exemption is applied, that assessed value drops.

Here’s a simple example: If your home is worth $300,000 and your state offers a $50,000 exemption, you’ll only be taxed on $250,000.

A Quick History of Homestead Exemptions

The concept of a “homestead” exemption dates back to the mid-1800s in the U.S., first appearing as a legal protection against the forced sale of a family home to pay debts. The idea was to shield homeowners — especially farmers and working families — from losing their residence during hard times.

The tax exemption aspect emerged later, particularly during the Great Depression, as local and state governments sought ways to stabilize communities and prevent a wave of property tax foreclosures. By reducing the taxable value of owner-occupied homes, homestead exemptions aimed to keep families housed, discourage displacement, and reward long-term residency.

Today, most states offer some form of exemption not just to reduce taxes, but also to:

- Promote homeownership

- Provide financial protection during economic downturns

- Help older adults and vulnerable populations stay in their homes

How Much Can You Save?

Savings vary widely by state — and sometimes by county or city. Here’s what that might look like:

- Texas: Up to $100,000 off your home’s value for school taxes (as of 2023)

- Florida: Up to $50,000 off, plus protections from steep tax increases

- Georgia: Typically between $2,000 and $10,000 in exemptions, depending on location

Types of Homestead Exemptions by State

- Fixed dollar amount: e.g., $25,000 or $50,000 off assessed value

- Percentage of home value: e.g., 10–20% in some counties

- Stacked exemptions: Additional savings for seniors, veterans, or disabled homeowners

- Automatic vs. application-based: Some counties apply it automatically, others require you to file

Pro Tip: These exemptions often renew automatically unless you move or refinance.

Beyond Tax Savings: Asset Protection & Home Equity

In many states, homestead exemptions do more than lower your tax bill. They can also protect some of your home’s equity from creditors in the event of bankruptcy or civil judgments.

Example: In Texas and Florida, strong homestead laws shield your primary residence from most unsecured creditors, which can offer peace of mind during financial hardship.

Who Qualifies for a Homestead Exemption?

Rules vary by state, but the basics are pretty consistent:

- You own the home

- It’s your primary residence (not a rental or second home)

- You lived there by January 1 of the tax year (in most states)

- You file an application before the deadline

Special Eligibility Categories

Some states offer additional exemptions for:

- Seniors (typically age 65+)

- Disabled homeowners

- Disabled veterans

- Low-income homeowners

Check your local rules to see if you qualify for any of these stacked benefits.

How to Apply (With State-by-State Tips)

Most states don’t apply the exemption automatically — you have to submit an application, usually to your local tax assessor or appraisal district.

Here’s what you’ll likely need:

- Proof of ownership (like a deed)

- Government-issued ID showing the property address

- A completed exemption application form (often online)

Filing Deadlines Matter

Many states require you to apply by March 1 or April 1. If you miss the deadline, you might lose out on the savings for the entire year.

State-by-State Snapshot

- Texas: File with your county appraisal district; deadline is April 30

- Florida: Apply online or in person by March 1

- California: Small exemption ($7,000), often applied automatically

- Illinois: Must reapply if you refinance or move

- Georgia: Application typically due by April 1

Watch Out: Refinancing or changing the title can trigger a reassessment — and possibly remove your exemption unless you refile.

How to Find Your Local Process

Since homestead exemptions are managed at the county level, the fastest way to find your process is to:

- Search your county name + “homestead exemption” (e.g., “Cook County homestead exemption”)

- Visit your local County Assessor’s or Appraisal District website

- Look for links labeled “Exemptions”, “Property Tax Relief”, or “Residential Applications”

You can also use this County Assessor Directory from the National Association of Counties (NACo) to find your local contact.

Common Mistakes That Cost You

- Missing the application deadline

- Failing to reapply after refinancing or moving

- Not updating your mailing address — you could miss important notices

- Assuming you’re enrolled automatically

- Believing rental or vacation homes qualify — they don’t

Myth vs. Reality

| Myth | Reality |

|---|---|

| “My lender takes care of it” | You must apply yourself in most states |

| “I only apply once” | You may need to reapply after refinancing or moving |

| “All homes qualify” | Only primary residences are eligible |

What Happens If You Move or Refinance?

In most states, your exemption won’t carry over automatically. You’ll likely need to:

- Reapply if you buy a new home

- Refile if you refinance — some lenders update title records that void the exemption

This is a common oversight that can cost you hundreds.

What Can Cause You to Lose Your Exemption?

- Renting out your home

- Moving out of the property

- Transferring title to a trust or LLC (check local rules)

- Failing to file a new application after refinance or purchase

Portability & Assessment Limits (In Some States)

Some states allow you to “port” your exemption or carry over capped assessments when you move within the state:

- Florida: Save Our Homes cap and portability lets you transfer some tax savings

- Georgia: Some counties cap assessment increases for long-term homeowners

Ask your county assessor if your benefits can transfer or reset.

Real-Life Example: How the Numbers Stack Up

Scenario: You buy a $400,000 home in a state with a $50,000 homestead exemption.

- Without exemption: Taxed on full $400,000

- With exemption: Taxed on $350,000

- If local property tax is 1.2%: That’s $600 per year in savings — and more over time if your assessment increases

Over 10 years, that’s potentially $6,000+ in tax relief.

Helpful Resources by State

- Florida Homestead Exemption

- Texas Comptroller – Homestead Info

- Georgia Homestead Guide

- Cook County (IL) Assessor

- NACo Directory to County Assessors

- Investopedia: Homestead Exemptions Explained

- State-by-State Comparison: World Population Review

Bottom Line

A homestead exemption is one of the most overlooked ways to reduce your property taxes. It only takes a few minutes to apply — and the savings can add up year after year.

✅ Not sure if your home is assessed correctly? Use the AHA Property Tax Appeal Assistant to explore your options and file a smart, supported appeal. You can also visit our Property Tax Appeal Guide for step-by-step help.