When your home is being appraised—whether for a sale, refinance, or equity loan—that number can feel personal. But here’s the truth: a home appraisal is a professional estimate of value, not a judgment on your taste, effort, or even your asking price. But that doesn’t make it stress-free.

So let’s break it down. What actually influences your home’s value? Can you do anything to prepare? And what if that number comes in lower than expected? This guide will help you navigate the process with confidence—not confusion.

What Is a Home Appraisal, Really?

A home appraisal is an independent, professional opinion of your home’s market value, typically required by a lender during refinancing, selling, or applying for a home equity loan. It protects both you and the bank from overborrowing or overpaying.

It’s not the same as a home inspection.

- An inspection checks for problems or safety concerns.

- An appraisal looks at how your home stacks up in the current market.

The appraiser considers your home’s size, condition, location, and comparable recent sales (“comps”) to determine value.

Snippet Answer: A home appraisal is a professional estimate of a property’s market value, required by lenders during real estate transactions.

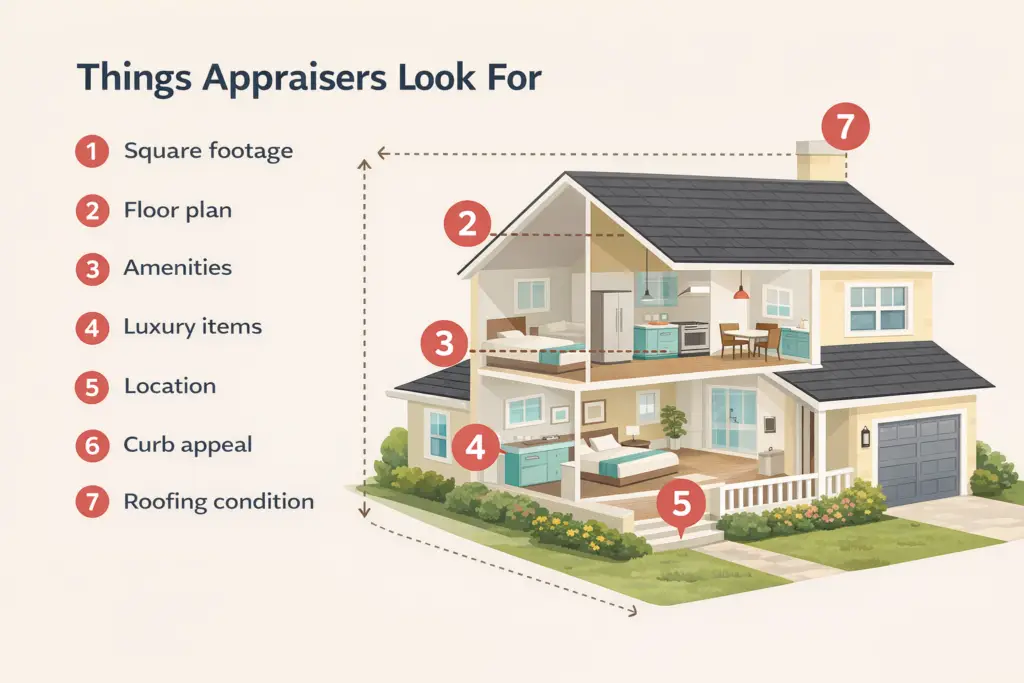

What Actually Affects Your Appraisal (And What Doesn’t)

Do matter:

- Recent nearby sales of similar homes (comps)

- Square footage and layout

- Age and condition of major systems (roof, HVAC, plumbing)

- Upgrades or renovations (especially kitchens, baths, energy features)

- Curb appeal and neighborhood trends

Don’t matter as much as you think:

- Interior decorating or furniture

- Your Zillow estimate (Zestimates can be off by thousands)

- What you paid for the home

- Sentimental value or effort put into the home

Example: One homeowner spent $10,000 on a koi pond. Gorgeous? Yes. Appraisal impact? Almost none.

Did You Know? Appraisals are usually valid for 90 days, but timelines can vary by lender or market.

Can You Prepare to Appraise Higher?

Yes—within reason. While you can’t change your square footage or comps, you can help the appraiser see your home at its best.

Here’s what to do:

- Tidy up inside and out. Think clean, not staged.

- Make minor repairs: leaky faucets, loose railings, peeling paint.

- Create a “home resume”: list of updates, dates, costs, permits — include photos if you can.

- Highlight energy improvements, like new insulation or solar panels.

Grab our step-by-step

Pre-Appraisal Checklist

Walk through exactly what to fix, clean, and gather before appraisal day.

Pro Tip: Be present, but not pushy. Hand your appraiser the “home resume” and let them work. Most appreciate the help.

What If the Appraisal Comes in Low?

First, don’t panic. Low appraisals happen—especially in fast-moving markets.

Here’s how to respond strategically:

- Ask your lender about a Reconsideration of Value: Provide better comps, highlight missed upgrades, or correct factual errors.

- Renegotiate the deal if you’re selling.

- Cancel or adjust the loan if refinancing.

In rare cases, you may be able to order a second appraisal, but it’s not always granted or different.

Watch Out: Rushing into big upgrades right before an appraisal rarely pays off. Most improvements need time to show up in market value.

Do Appraisals Impact Your Taxes or Insurance?

Usually not. Property tax assessments and insurance valuations are done separately, with different formulas.

However, if your appraisal reveals your home is worth less than expected, it might be worth challenging your tax assessment.

AHA members can use the AHA Property Tax Appeal Assistant to evaluate and appeal overinflated property assessments.

What About Appraisal Bias or Inconsistencies?

There’s growing awareness about appraisal bias based on neighborhood or owner demographics. It’s a complex issue, but if you suspect unfair treatment:

- Document everything

- Request the appraiser’s credentials

- Ask your lender for a second opinion

Fair housing laws exist to protect homeowners from discriminatory practices—and AHA supports those protections.

Conclusion: Don’t Let That Number Rattle You

A home appraisal is just one perspective on your home’s value—not its final word. By understanding what affects it, prepping strategically, and knowing your options if it comes in low, you can navigate the process with less stress and more control.

Want more support? Explore AHA’s homeowner tools, like the Property Tax Appeal Assistant and Home Inventory System, to take charge of your home’s value year-round.